Electoral Bond Scheme 2018

Context:

The Government of India has notified the Electoral Bond Scheme 2018 Sale by Authorised Branches of State Bank of India (SBI) during July 01-10, 2021

About :

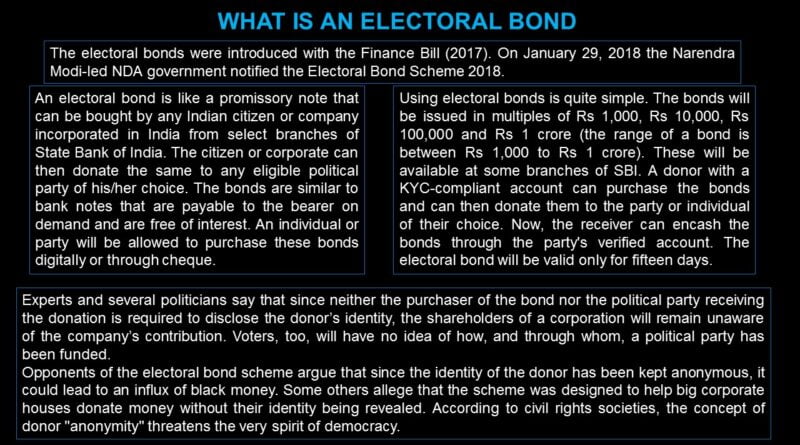

- An electoral bond is like a promissory note that can be bought by any Indian citizen or company incorporated in India from select branches of State Bank of India.

- The citizen or corporate can then donate the same to any eligible political party of his/her choice.

- The bonds are similar to bank notes that are payable to the bearer on demand and are free of interest.

- An individual or party will be allowed to purchase these bonds digitally or through cheque.

- The electoral bonds were introduced with the Finance Bill (2017). On January 29, 2018 NDA government notified the Electoral Bond Scheme 2018.

How to use electoral bonds?

The bonds will be issued in multiples of Rs 1,000, Rs 10,000, Rs 100,000 and Rs 1 crore (the range of a bond is between Rs 1,000 to Rs 1 crore). These will be available at some branches of SBI. A donor with a KYC-compliant account can purchase the bonds and can then donate them to the party or individual of their choice. Now, the receiver can encash the bonds through the party’s verified account. The electoral bond will be valid only for fifteen days.

Electoral bonds: Conditions

1. Any party that is registered under section 29A of the Representation of the Peoples Act, 1951 and has secured at least one per cent of the votes polled in the most recent General elections or Assembly elections is eligible to receive electoral bonds. The party will be allotted a verified account by the Election Commission of India (ECI) and the electoral bond transactions can be made only through this account.

2. The electoral bonds will not bear the name of the donor. Thus, the political party might not be aware of the donor’s identity.

Are electoral bonds taxable?

In February 2017, the then finance minister Arun Jaitley said that the donations would be tax deductible. Hence, a donor will get a deduction and the recipient, or the political party, will get tax exemption, provided returns are filed by the political party.

Why were electoral bonds introduced in India?

According to government, electoral bonds were being introduced to ensure that all the donations made to a party would be accounted for in the balance sheets without exposing the donor details to the public.

The government said that electoral bonds would keep a tab on the use of black money for funding elections. In the absence of electoral bonds, donors would have no option but to donate by cash after siphoning off money from their businesses, the government said.

Previous System of funding

- Before the budget of 2017, if a political party got a donation of less than Rs. 20,000 from a donor, then it was not mandatory to reveal the source of fund.

- This rule was misused and near about all the political parties said that they received 90% of their political fund in the denomination of less than Rs. 20000.

- So a huge amount of black money was generated and used in the election campaigning.

- On the basis of the recommendation of the Election Commission, in Budget 2017 the government reduced the limit of anonymous donation to Rs. 2000 only.

- The concept of Electoral bonds was introduced in the Finance Bill 2017, and was facilitated through multiple amendments in the Finance Act 2017.

Criticism

- The Communist Party of India (Marxist) and the NGO Association for Democratic Reforms (ADR) had moved to the SC against the electoral bonds.

- They argued, ordinary citizens will not know who is donating how much to which political party, and it would add to the woes of the Indian democracy.

- It may also tilt the balance in favour of one political party. For example, in FY 2018, the ruling party received 95% of the total bonds

- Private corporate interests may take precedence over the needs and rights of the people of the State in policy considerations.

Supreme Court’s stand

- According to SC, if the identity of the buyers of electoral bonds is not known, the efforts of the government to curtail black money in elections would be “futile”.

- It has directed the Finance Ministry to reduce window of purchasing electoral bonds.

- It has directed all political parties to furnish receipts of funding received through electoral bonds and details of identity of donors in a sealed cover to the Election Commission.

Central Governments stand

- Electoral Bond Scheme is an alternative to cash donations to ensure transparency in political funding, and check the use of black money for funding elections.

- Political party have to file returns before the EC as to how much money has come through electoral bonds, which will provide

- The right of the buyer to purchase bonds without having to disclose his preference of political party is in furtherance of his right to privacy.

- Keeping the identity of the donor anonymous is also an extension to his right to vote in secret ballot.

- Allegations that nobody would know about the donors is wrong, as the Income Tax department will have access to this information.

Conclusion

It can be said that the release of electoral bonds will restrict the generation of black money up to some extent. But the rule that identity of the donors will be kept confidential may make futile the exercise to eliminate black money, as it may just end up making Black money White.

Source: PIB