Money Bill

Context:

In a pre-emptive move, the Congress has written to Lok Sabha Speaker Om Birla, urging him not to bypass the Rajya Sabha by declaring seven key Bills, including one on the privatisation of two public sector banks, as money Bills.

What is a Money bill?

A money bill is defined by Article 110 of the Constitution, as a draft law that contains only provisions that deal with all or any of the matters listed therein.

These comprise a set of seven features, broadly including items such as

- The imposition, abolition, remission, alteration or regulation of any tax

- The regulation of the borrowing of money by the Union government

- The custody of the Consolidated Fund of India or the contingency fund of India, the payment of money into or the withdrawal of money from any such fund

- The appropriation of money out of the Consolidated Fund of India

- Declaration of any expenditure charged on the Consolidated Fund of India or increasing the amount of any such expenditure

- The receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money, or the audit of the accounts of the Union or of a state

- Any matter incidental to any of the matters specified above

In the event a proposed legislation contains other features, ones that are not merely incidental to the items specifically outlined, such a draft law cannot be classified as a money bill.

Article 110 further clarifies that in cases where a dispute arises over whether a bill is a money bill or not, the Lok Sabha Speaker’s decision on the issue shall be considered final.

Bill is not a Money Bill when it provides for

- Imposition of fines or other pecuniary penalties

- Demand or payment of fees for licenses or fees for services rendered

- Imposition, abolition, remission, alteration or regulation of any tax by any local authority or body for local purposes

What are the different types of Bills? There are four types of Bills, namely

- i) Constitution Amendment Bills; (ii) Money Bills; (iii) Financial Bills; and (iv) Ordinary Bills.

What are the features of each of these Bills?

- Constitution Amendment Bills: These are Bills which seek to amend the Constitution.

- Money Bills: A Bill is said to be a Money Bill if it only contains provisions related to taxation, borrowing of money by the government, expenditure from or receipt to the Consolidated Fund of India. Bills that only contain provisions that are incidental to these matters would also be regarded as Money Bills.

- Financial Bills: A Bill that contains some provisions related to taxation and expenditure, and additionally contains provisions related to any other matter is called a Financial Bill. Therefore, if a Bill merely involves expenditure by the government, and addresses other issues, it will be a financial bill.

- Ordinary Bills: All other Bills are called ordinary bills.

How are these bills passed?

- Constitution Amendment Bills: A Constitution Amendment Bill must be passed by both Houses of Parliament. It would require a simple majority of the total membership of that House, and a two thirds majority of all members present and voting. Further, if the Bill relates to matters like the election of the President and Governor, executive and legislative powers of the centre and states, the judiciary, etc., it must be ratified by at least half of the state legislatures.

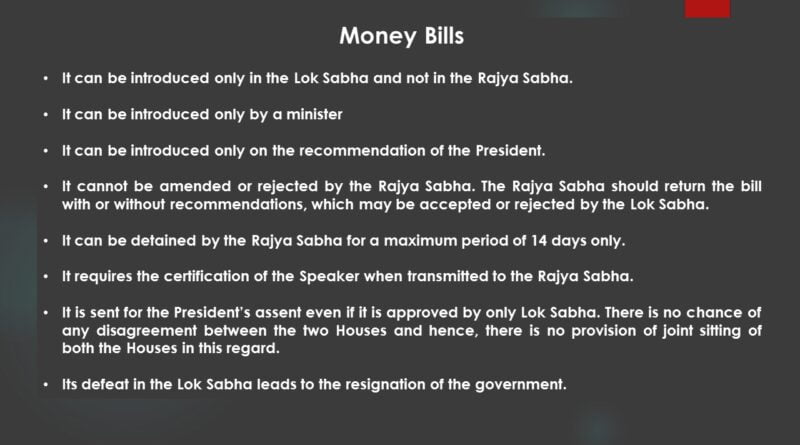

- Money Bills:A Money Bill may only be introduced in Lok Sabha, on the recommendation of the President. It must be passed in Lok Sabha by a simple majority of all members present and voting. Following this, it may be sent to the Rajya Sabha for its recommendations, which Lok Sabha may reject if it chooses to. If such recommendations are not given within 14 days, it will deemed to be passed by Parliament.

- Financial Bills: A Financial Bill may only be introduced in Lok Sabha, on the recommendation of the President. The Bill must be passed by both Houses of Parliament, after the President has recommended that it be taken up for consideration in each House.

- Ordinary Bills: An Ordinary Bill may be introduced in either House of Parliament. It must be passed by both Houses by a simple majority of all members present and voting.

How is a Money Bill different from a financial bill?

- While all Money Bills are Financial Bills, all Financial Bills are not Money Bills.

- For example, the Finance Bill which only contains provisions related to tax proposals would be a Money Bill.

- However, a Bill that contains some provisions related to taxation or expenditure, but also covers other matters would be considered as a Financial Bill.

- The Compensatory Afforestation Fund Bill, 2015, which establishes funds under the Public Account of India and states, was introduced as a Financial Bill.

- Secondly, as highlighted above, the procedure for the passage of the two bills varies significantly.

- The Rajya Sabha has no power to reject or amend a Money Bill. However, a Financial Bill must be passed by both Houses of Parliament.

- Who decides if a Bill is a Money Bill? The Speaker certifies a Bill as a Money Bill, and the Speaker’s decision is final. Also, the Constitution states that parliamentary proceedings as well as officers responsible for the conduct of business (such as the Speaker) may not be questioned by any Court.

| Difference | Money Bill | Financial Bill |

| Article | Article 110 | Article 117 (I) Article 117 (II) |

| Meaning | Exclusively deals with the financial matters prescribed under Article 110 | Deals with the provisions of revenue and expenditure |

| Form | Government Bill | Ordinary Bill |

| Introduced In | Lok Sabha Only | Bills under Article 117 (1) can be introduced in Lok Sabha only Bills under Article 117 (3) can be introduced in both the houses. |

| President’s Prior Approval | Required | Required |

| Speaker’s Certification | Yes | No |

| Rajya Sabha’s Role | No Role | Same role as that of Lok Sabha |

| Joint Sitting | No Provision | Yes, if any deadlock |

Source: The Hindu

MAINS PRACTICE QUESTIONS

Q. What do you understand by money bill and how is it different from the financial bill? Examine the criteria a bill needs to fulfill to be termed as a money bill. (250 words)