Supply Chain Resilience Initiative (SCRI)

Context:

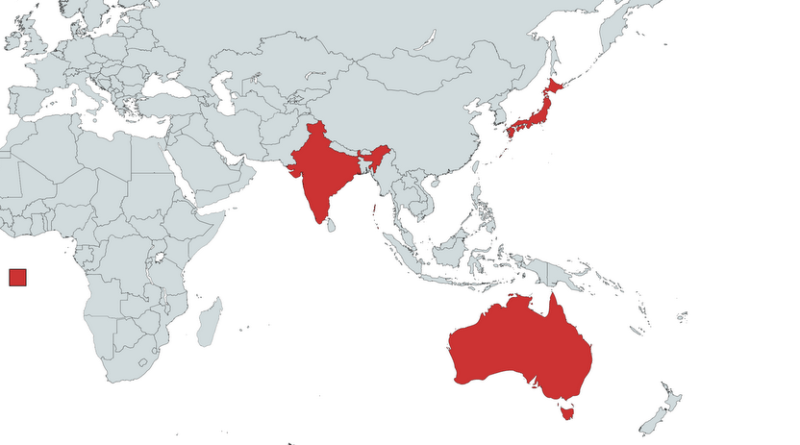

In a move to counter China’s dominance of supply chain in the Indo-Pacific region, trade ministers of India, Japan and Australia have formally launched the Supply Chain Resilience Initiative (SCRI).

Supply Chain Resilience:

- When assembly lines are heavily dependent on supplies from one country, the impact on importing nations could be crippling if that source stops production intentionally (economic sanction) or unintentionally (natural disaster)

- Example: Japan imported $169 billion worth from China, accounting for 24% of its total imports. Japan’s imports from China fell by half in February 2020 that impacted Japan’s economic activity.

- In the context of international trade, supply chain resilience is an approach that helps a country to ensure that it has diversified its supply risk across a clutch of supplying nations instead of being dependent on just one or a few.

Supply Chain Resilience Initiative (SCRI):

- Geo-politics and geo-economics can never be truly separated.

- Also, there is a growing trend of weaponization of trade and technology.

- China had imposed sanctions on its key exports of grain, beef, wine, coal, etc to Australia for demanding an inquiry into the origins of the coronavirus and advocating a robust Indo-Pacific vision.

- It is against this backdrop that India, Japan, and Australia initiated the Supply Chain Resilience Initiative (SCRI).

- It focuses on automobiles and parts, petroleum, steel, textiles, financial services, and IT sectors.

- The SCRI may be strengthened by the future involvement of France.

- Kingdom has also shown interest in the SCRI.

Objective:

- To attract foreign direct investment to turn the Indo-Pacific into an “economic powerhouse”.

- To build a mutually complementary relationship among partner countries.

- To work out a plan to build on the existential supply chain network. Japan and India, for example, have an India-Japan competitiveness partnership dealing with locating the Japanese companies in India.

Reasons for the Initiative:

- Covid-19 Realization: With spread of Covid-19 globally, it has been realized that dependence over a single nation is not good for both global economy and national economies:

- Assembly lines are heavily dependent on supplies from one country.

- The impact on importing nations could be crippling if the source stops production for involuntary reasons, or even as a conscious measure of economic coercion.

- USA-China Trade Tensions: The tensions began when the United States and China both applied tariff sanctions on eachother.

- India as an Emerging Supply Hub: The businesses have started seeing India as a “hub for supply chains”.

Chinese Import to India:

- As per the Confederation of Indian Industry, China’s share of imports into India in 2018 (considering the top 20 items supplied by China) stood at 14.5%.

- Chinese supplies dominate segments of the Indian economy. Sectors that have been impacted by supply chain issues arising out of the pandemic include pharmaceuticals, automotive parts, electronics, shipping, chemicals and textiles.

- In areas such as Active Pharmaceutical Ingredients for medicines such as paracetamol, India is fully dependent on China.

- In electronics, China accounts for 45% of India’s imports.

What is Japan proposing?

- The pandemic has brought into sharp focus the assembly lines which are heavily dependent on supplies from one country.

- While Japan exported $135 billion worth of goods to China in 2019, it also imported $169 billion worth from the world’s second-largest economy, accounting for 24% of its total imports.

- So, any halt to supplies could potentially impair economic activity in Japan.

- In addition, the U.S.-China trade tensions have caused alarm in Japanese trade circles for a while now.

- If the world’s two largest economies do not resolve their differences, it could threaten globalisation as a whole and have a major impact on Japan.

- It is heavily reliant on international trade both for markets for its exports and for supplies of a range of primary goods from oil to iron ore.

Japan eyeing India as a partner for the SCRI

- Japan is the fourth-largest investor in India with cumulative FDIs touching $33.5 billion in the 2000-2020 periods.

- It accounts for 7.2% of inflows in that period, according to quasi-government agency India Invest.

- Imports from Japan into India more than doubled over 12 years to $12.8 billion in FY19. Exports from India to the world’s third-largest economy stood at $4.9 billion that year, data from the agency showed.

- It is a clear reflection that the two countries are unlikely to allow individual cases to cloud an otherwise long-standing and deepening trade relationship.

Where does Australia stand?

- Australia, Japan and India are already part of another informal grouping, the Quadrilateral Security Dialogue, or the Quad, which includes the U.S.

- Media reports indicate that China has been Australia’s largest trading partner and that it counts for 32.6% of Australia’s exports, with iron ore, coal and gas dominating the products shipped to Asia’s largest economy.

- But relations including trade ties between the two have been deteriorating for a while now.

- China banned beef imports from four Australian firms in May and levied import tariffs on Australian barley.

Atmanirbhar Bharat

- It is aimed at strengthening India’s capacities to participate more vigorously without being prey to supply chain disruptions.

- GoI is providing a big boost to defence manufacturing under the ‘Make in India’ programme. It has identified a negative import list of 101 items.

- India is seeking to enhance its presence substantially in the global supply chains by attracting investments in the semiconductor components and packaging industry.

- The government is actively promoting domestic manufacture of printed circuit boards (PCBs), components and semiconductors, as the Indian electronics sector gradually shifts away from completely knocked down (CKD) assembly to high value addition.

- India has the capacity and the potential to become one of the world’s largest destinations for investments, and one of the world’s largest manufacturing hubs, in the aftermath of the pandemic.

India’s vulnerability to supply chain disruptions

- India can ill-afford the shocks of disruption in supply chains.

- For instance, the pandemic caused a breakdown in global supply chains in the automotive sector.

- For India, which imports 27% of its requirement of automotive parts from China, this quandary was a wake-up call.

- It is t is noteworthy is that despite being the fourth largest market in Asia for medical devices, India has an import dependency of 80%.

- Given the renewed thrust in the health-care sector, this is the right time to fill gaps through local manufacturing.

India increasing its presence in global supply chains

1) Electronic industry

- India’s electronics industry was worth $120 billion in 2018-2019 and is forecast to grow to $400 billion by 2025.

- India is enhancing its presence in the global supply chains by attracting investments in the semiconductor components and packaging industry.

- The Indian electronics sector is gradually shifting away from completely knocked down (CKD) assembly to high-value addition.

2) Defence sector

- Defence is among the key pillars of the ‘Atmanirbhar Bharat’ policy.

- The government is providing a big boost to defence manufacturing under the ‘Make in India’ program.

- It has identified a negative import list of 101 items.

- There is a tremendous opportunity for foreign companies to enter into tie-ups with reputed Indian defence manufacturers to tap into the growing defence market in India.

India’s stand to gain or lose

- Following the border tensions, partners such as Japan have sensed that India may be ready for dialogue on alternative supply chains.

- Earlier, India would have done little to overtly antagonize China. But an internal push to suddenly cut links with China would be impractical.

- China’s share of imports into India in 2018 stood at 14.5%. It supplies dominate segments of the Indian economy.

- Sectors that have been impacted by supply chain issues arising out of the pandemic include pharmaceuticals, automotive parts, electronics, shipping, chemicals and textiles.

- Over time, if India enhances self-reliance or works with exporting nations other than China, it could build resilience into the economy’s supply networks.

Suggestions for India

- India needs to enhance self-reliance against China, so that it could build resilience into the economy’s supply networks. Economic measures are of real value in this regard.

- Ease of Doing Business: While India appears an attractive option for potential investors both as a market and as a manufacturing base, it needs to accelerate progress in ease of doing business and in skill building.

- Tax incentives: These will help in attracting investments from China and other attractive locations like Vietnam and the Philippines.

- Boost Domestic Manufacturing: India’s strategy should be to boost manufacturing competitiveness and increase its share in world trade.

- Infrastructure Boost: In this pursuit, there is a need to create an infrastructure that raises the competitiveness of India’s exports.

- Removing Structural Bottlenecks: There is a need to push through long-pending legislation that aims to address the structural bottlenecks (in 4Ls: Land, Labour, Law, Liquidity) that continue to plague and hinder domestic competitiveness.

- Leveraging Service Sector: In spite of banning Chinese imports, India should tackle trade by trade.

- India can lobby for a more liberalized service sector (India’s comparative advantage) in China.

Source: PIB