Ways and Means Advances (WMA) scheme

Context:

The Reserve Bank of India (RBI) has decided to continue with the existing interim Ways and Means Advances (WMA) scheme limit of Rs. 51,560 crore for all States/UTs upto September 2021, given the prevalence of Covid-19.

What is the meaning of ways and means advances?

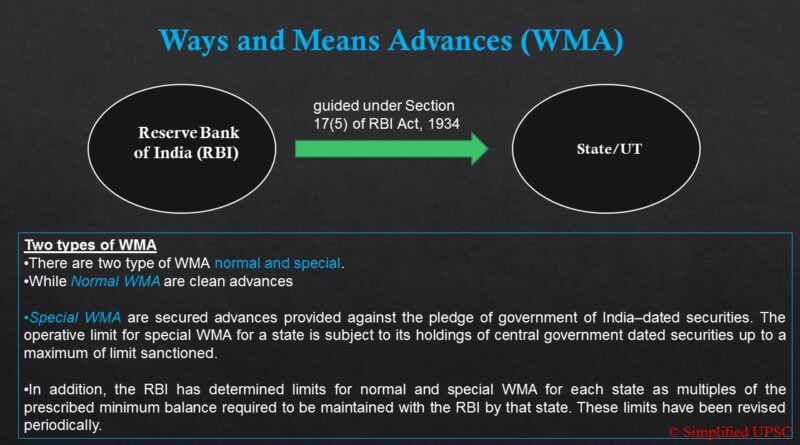

- It is a mechanism used by Reserve Bank of India (RBI) under its credit policy to provide to States, banking with it, to help them tide over temporary mismatches in the cash flow of their receipts and payments.

- This is guided under Section 17(5) of RBI Act, 1934, and are ‘repayable in each case not later than three months from the date of making that advance’.

- These are temporary advances (overdrafts) extended by RBI to the govt. Section 17(5) of RBI Act allows RBI to make WMA both to the Central and State Govt.

Objective

To bridge the interval between expenditure and receipts. They are not sources of finance but are meant to provide support, for purely temporary difficulties that arise on account of mismatch/shortfall in revenue or other receipts for meeting the govt. liabilities. They have to be periodically adjusted to enable use of such financing for future mismatches. On 26 March 1997, Govt. of India and RBI signed an agreement putting the ad hoc T-bills system to end w.e.f 1 April 1997.

Two types of WMA

- There are two type of WMA normal and special.

- While Normal WMA are clean advances

- Special WMA are secured advances provided against the pledge of government of India–dated securities. The operative limit for special WMA for a state is subject to its holdings of central government dated securities up to a maximum of limit sanctioned.

- In addition, the RBI has determined limits for normal and special WMA for each state as multiples of the prescribed minimum balance required to be maintained with the RBI by that state. These limits have been revised periodically.

Normal WMA

The historical evolution of the Normal WMA facility is presented in Annexe-II.I. Normal WMA limits were earlier related to the minimum balances held by each State. A major change in the principles adopted for working out the WMA limits occurred in 1999 consequent to the recommendations made by the Informal Advisory Committee (IAC) on WMA to State Governments referred to in Chapter I. The IAC recommended delinking the practice of relating the size of the Normal WMA limit to the minimum balance held by the States and instead proposed linking it to the budgetary turnover of the State. This was justified on the ground that the size of the liquidity mismatch would be a function of the size of the budgetary transactions. In linking the WMA limits to the level of budgetary operations of the State, the IAC further advocated uniformity with regard to all States. In reckoning the level of budgetary operations, the IAC excluded revenue deficit of the States as the States are expected to operate within their available resources.

Special WMA

The scheme of Special or secured WMA, which is granted against the collateral of Central Government dated securities and Treasury Bills held by the State Governments with RBI, was first introduced on April 1, 1953 when a uniform limit of Rupees two crore was allocated to each State. The sanctioned limits of Special WMA linked to the minimum balance had been revised upwards from 1967 to 1999. A brief historical review of special WMA is given in Annexe-II.II.

The scheme had not been effectively used by the State Governments since its inception as the operative limits were lower than their sanctioned limits in the absence of sufficient collaterals held by the States. However, the IAC was of the view that a scheme which encouraged the States to build up reserves in the shape of Central Government securities should not be discontinued. The IAC, therefore, recommended that the Special WMA should also be delinked from minimum balances and that States be allowed to draw Special WMA freely against their holdings of Government of India securities. Since 1999, the limits are directly proportional to the State Governments’ holdings of Government of India dated securities and Treasury Bills without any ceiling. Accordingly the State Governments are being allowed Special WMA to the extent of around 85 to 90 per cent of the market value of their holdings of such securities after providing for margins against price risk, with a higher margin for securities of residual maturity in excess of 10 years.

Significance:

- The cash flow problems of States have been aggravated by the impact of Covid-19, thus many States are in need of immediate and large financial resources to deal with challenges, including medical testing, screening and providing income and food security to the needy.

- WMA can be an alternative to raising longer-tenure funds from the markets, issue of State government securities (State development loans) or borrowing from financial institutions for short-term funding. WMA funding is much cheaper than borrowings from markets.

Other Related Decisions:

- The Special Drawing Facility (SDF) availed by State Governments/UTs shall continue to be linked to the quantum of their investments in marketable securities issued by the Government of India, including the Auction Treasury Bills (ATBs).

- The annual incremental investments in Consolidated Sinking Fund (CSF) and Guarantee Redemption Fund (GRF) shall continue to be eligible for availing of SDF.

| Auction Treasury Bills These are money market instruments issued by the Government of India as a promissory note with guaranteed repayment at a later date. Funds collected through such tools are typically used to meet short term requirements of the government, hence, to reduce the overall fiscal deficit of a country. Consolidated Sinking Fund CSF was set up in 1999-2000 by the RBI to meet redemption of market loans of the States. Initially, 11 States set up sinking funds. Later, the 12th Finance Commission (2005-10) recommended that all States should have sinking funds for amortization of all loans, including loans from banks, liabilities on account of National Small Saving Fund (NSSF), etc. The fund should be maintained outside the consolidated fund of the States and the public account. It should not be used for any other purpose, except for redemption of loans. As per the scheme, State governments could contribute 1-3% of the outstanding market loans each year to the Fund. The Fund is administered by the Central Accounts Section of RBI Nagpur. Guarantee Redemption Fund A Guarantee Redemption Fund (GRF) has been established in the Public Account of India from 1999-2000 for redemption of guarantees given to Central Public Sector Enterprises (CPSEs), Financial Institutions, etc. by the Union Government whenever such guarantees are invoked. The fund is fed through budgetary appropriations with an annual provision in the Budget Estimates (BE).On the recommendations of Twelfth Finance Commission, fifteen States have set up a Guarantee Redemption Fund. This fund is maintained outside the consolidated fund of the States in the public account and is not to be used for any other purpose, except for redemption of loans. This ensures good fiscal governance. |

Source: The Hindu