Agriculture Infrastructure Fund (AIF)

Contents

Agriculture Infrastructure Fund (AIF)

The Agriculture Infrastructure Fund (AIF) is a transformative Central Sector Scheme launched in 2020 to revolutionize India’s agricultural infrastructure and post-harvest management capabilities. With a substantial allocation of ₹1 lakh crore over 13 years (2020-21 to 2032-33), the scheme aims to bridge critical gaps in farm-gate storage, logistics, and processing infrastructure.

Scheme Overview and Objectives

The AIF represents a comprehensive medium to long-term debt financing facility designed to mobilize investments in viable projects for post-harvest management infrastructure and community farming assets through interest subvention and credit guarantee support. The scheme’s primary objectives include:

Enhancing post-harvest management infrastructure to minimize crop losses and improve farmer incomes

Facilitating modern packaging and cold storage systems enabling farmers to sell produce on favorable terms

Increasing private investments in the agricultural sector through attractive financing options

Reducing national food wastage percentage through improved storage and processing facilities

Leveraging new-age technologies like IoT and AI for agricultural innovation

Connecting agri-entrepreneurs and startups with funding opportunities

Eligible Beneficiaries

The scheme adopts an inclusive approach, welcoming diverse stakeholders in the agricultural ecosystem:

Individual Farmers and Farmer Groups

Farmer Producer Organizations (FPOs)

Primary Agricultural Credit Societies (PACS)

Marketing Cooperative Societies

Self Help Groups (SHGs) and Joint Liability Groups (JLGs)

Multipurpose Cooperative Societies

Agri-entrepreneurs and Startups

National and State Federations of Cooperatives

Central/State agency or Local Body sponsored Public-Private Partnership Projects

Exclusions: Public Sector Undertakings (PSUs) are not directly eligible, though PPP projects sponsored by them qualify for support.

Financial Framework and Benefits

Loan Structure

Aggregate Loan Facility: ₹1 lakh crore from various lending institutions

Interest Rate Cap: Maximum 9% per annum on loans

Loan Quantum: Up to ₹2 crore covered under guarantee and subvention; higher amounts considered but without scheme benefits

Repayment Period: 7 years with flexible repayment based on project cash flow

Moratorium: 6 months to 2 years (interest payable during moratorium)

Key Financial Incentives

Interest Subvention: All loans receive 3% per annum interest subvention up to ₹2 crore limit for maximum 7 years. For loans exceeding ₹2 crore, subvention applies only to the first ₹2 crore.

Credit Guarantee Coverage: Comprehensive coverage under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) for loans up to ₹2 crore, with government bearing the guarantee fee.

Enhanced Coverage (2024 Expansion): NABSanrakshan Trustee Company Pvt. Ltd. now provides additional credit guarantee coverage for FPOs, expanding financial security options.

Eligible Projects and Infrastructure

Post-Harvest Management Infrastructure

Storage Facilities: Warehouses, silos, cold stores, and cold chain facilities

Processing Units: Primary processing centers, grading, sorting, and cleaning facilities

Packaging and Value Addition: Packing units, ripening chambers, waxing plants

Logistics Infrastructure: Reefer vans, insulated vehicles, supply chain services

Community Farming Assets

Advanced Farming Systems: Hydroponic farming, mushroom cultivation, vertical farming, aeroponic farming

Protected Cultivation: Polyhouse/greenhouse infrastructure

Smart Agriculture: Infrastructure for precision agriculture and IoT-enabled farming

Custom Hiring Centers: Shared mechanization facilities

Specialized Infrastructure

Organic Input Production Units: Bio-stimulant production, nurseries, tissue culture facilities

Quality Infrastructure: Assaying units, testing laboratories

Marketing Platforms: E-marketing platforms, private mandis

Recent Expansions and Enhancements (2024)

The Union Cabinet approved significant expansions to the AIF scheme in August 2024, making it more comprehensive and inclusive:

Viable Farming Assets Expansion

All eligible beneficiaries can now create infrastructure for viable community farming assets, enhancing collective farming capabilities and sustainability.

Integrated Processing Projects

The scheme now includes integrated primary and secondary processing projects, though standalone secondary projects remain under Ministry of Food Processing Industries schemes.

PM-KUSUM Convergence

Component-A of PM-KUSUM scheme can now converge with AIF for farmers, FPOs, cooperatives, and panchayats, promoting sustainable clean energy solutions alongside agricultural infrastructure.

Enhanced Credit Guarantee

NABSanrakshan Trustee Company Pvt. Ltd. provides additional credit guarantee coverage for FPOs beyond existing CGTMSE coverage, strengthening financial security.

Implementation Mechanism

Participating Financial Institutions

The scheme operates through a robust network of lending institutions including:

24 Scheduled Commercial Banks

40 Scheduled Cooperative Banks

Regional Rural Banks (RRBs)

Small Finance Banks and NBFCs

National Cooperative Development Corporation (NCDC)

NABARD with special provisions for PACS

Monitoring and Evaluation Framework

The government employs a comprehensive multi-tiered monitoring mechanism to ensure effective implementation and impact assessment:

Technology-Enabled Monitoring

AIF Online MIS Portal: Real-time project tracking from sanction to implementation

Geo-tagging: Physical progress monitoring and regional distribution assessment

AI and Data Analytics: Impact analysis on yield improvements and post-harvest loss reduction

Third-Party Assessment

Independent Field Evaluations: Agro-Economic Research Centre (AERC) Pune conducted comprehensive impact studies

Stakeholder Consultations: Regular feedback mechanisms with banks and state governments

District and State-Level Committees: Localized monitoring and alignment with regional needs

Performance and Impact Assessment

Infrastructure Creation

Since its launch, AIF has demonstrated remarkable success in infrastructure development:

6,623 Warehouses constructed nationwide

688 Cold Storage Units established

21 Silos Projects completed

Additional Storage Capacity: Approximately 500 LMT (465 LMT dry storage + 35 LMT cold storage)

Financial Performance

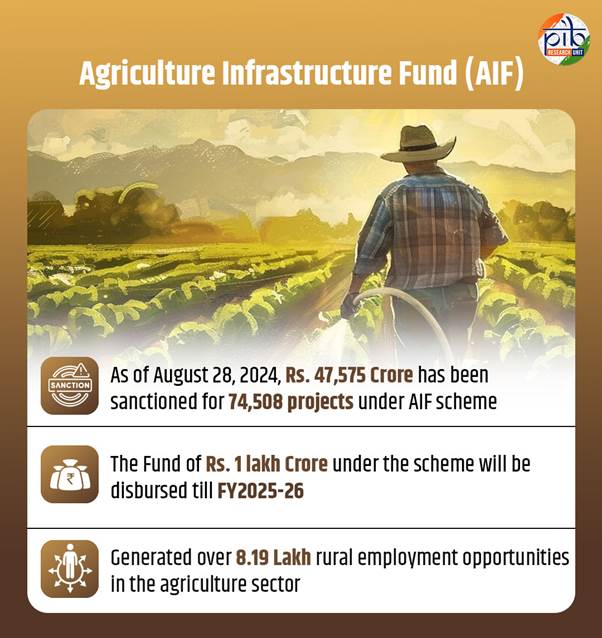

₹47,575 Crore Sanctioned for 74,508 projects as of August 2024

₹78,596 Crore Total Investment Mobilized in agriculture sector

₹78,433 Crore Private Investment attracted through the scheme

Socio-Economic Impact

8.19+ Lakh Rural Employment Opportunities generated in agriculture sector

18.6 LMT Food Grains can be saved annually through improved storage

3.44 LMT Horticulture Produce preservation capacity added

State-wise Allocation Examples

The scheme provides tentative state-wise allocations based on agricultural output ratios:

Maharashtra: ₹8,460 crore allocation

North-Eastern States: ₹3,516 crore total allocation, with Assam receiving ₹2,050 crore

Convergence and Integration

The AIF scheme demonstrates strong convergence with multiple government initiatives:

State and Central Government Schemes: Integration with AMI, ACABC, PMEGP, NHB, MIDH programs

PM-KUSUM Scheme: Component-A convergence for clean energy solutions

CGTMSE Integration: Credit guarantee support for micro and small enterprises

NABSanrakshan Convergence: Enhanced FPO support mechanisms

Project Limitations and Eligibility Criteria

Project Scale

Maximum Projects per Entity: Up to 25 projects at different locations

Minimum Promoter Contribution: 10% of project cost mandatory

Loan Coverage: Full scheme benefits available only up to ₹2 crore

Non-Eligible Activities

Standalone Secondary Processing: Covered under MoFPI schemes

Government Sector: Direct PSU participation excluded

Residential or Commercial Infrastructure: Outside agricultural scope

The Agriculture Infrastructure Fund represents a landmark initiative in India’s agricultural transformation journey, providing comprehensive support for infrastructure development while ensuring financial accessibility and technical viability. Through its expanded scope and enhanced features, the scheme continues to strengthen India’s agricultural infrastructure ecosystem, supporting the government’s vision of doubling farmer incomes and achieving sustainable agricultural growth.

Source: PIB

Discover more from Simplified UPSC

Subscribe to get the latest posts sent to your email.