Promotion of Research and Innovation in Pharma-MedTech Sector (PRIP) Scheme

Contents

Promotion of Research and Innovation in Pharma-MedTech Sector (PRIP) Scheme

Sector: Pharmaceuticals & Medical Devices

Policy Anchor: Department of Pharmaceuticals (DoP), Ministry of Chemicals & Fertilizers, Government of India

1. Executive Summary

The Promotion of Research and Innovation in Pharma MedTech Sector (PRIP) scheme represents a pivotal shift in India’s pharmaceutical industrial policy, moving from a “volume-based” manufacturing approach to a “value-based” innovation ecosystem. With a total financial outlay of ₹5,000 Crore (approx. $600M), the scheme is designed to catalyze R&D in high-priority areas where India currently lags, such as New Chemical Entities (NCEs), precision medicine, and advanced medical devices.

Unlike previous interventions (like the PLI schemes) that focused on manufacturing capacity, PRIP focuses on intellectual property (IP) creation. It employs a dual-component structure: building public research infrastructure (Component A) and directly funding private sector R&D projects (Component B). As of late 2025, the scheme is actively soliciting proposals, marking a critical window for startups, MSMEs, and major pharma players to leverage government risk-capital for high-risk, high-reward innovations.

2. Strategic Context: The “Volume to Value” Transition

India’s pharmaceutical sector has long been the “Pharmacy of the World,” supplying ~20% of global generic medicines. However, this dominance is built on thin margins and commodities. The strategic necessity for PRIP arises from three pressures:

- Stagnating Generics Growth: The simple generics market is saturated, with intense price erosion in the US and EU markets.

- Import Dependence: despite export strength, India remains heavily dependent on imports for high-end medical devices (80%) and Key Starting Materials (KSMs).

- The Innovation Gap: Global pharma majors invest 15-20% of revenue in R&D; Indian majors average 7-9%, mostly focused on generic filing (ANDAs) rather than novel drug discovery.

Strategic Fit: PRIP acts as the “software” complement to the “hardware” of the PLI (Production Linked Incentive) schemes. While PLI builds factories, PRIP builds the IP pipeline to fill them with high-value products.

3. Scheme Architecture & Components

The scheme is operationalized through two distinct components, designed to address both infrastructure gaps and funding shortages.

Component A: Infrastructure Strengthening (₹700 Cr)

- Objective: To create world-class research hubs that industry can access, reducing capital expenditure (Capex) for private players.

- Execution: Establishment of 7 Centers of Excellence (CoEs) at the National Institutes of Pharmaceutical Education and Research (NIPERs).

- Strategic Intent: Each NIPER is assigned a specialization (e.g., Mohali for Anti-viral/Anti-bacterial, Ahmedabad for Medical Devices). This creates “clusters of competence,” allowing startups in those regions to access specialized labs they could not afford independently.

Component B: Direct R&D Funding (₹4,250 Cr)

- Objective: To provide financial assistance for specific research projects in priority areas.

- Mechanism: Risk-sharing funding. The government does not fund 100% of the project but acts as a catalyst.

- Beneficiaries: Divided into three categories to ensure inclusivity:

- Category I: Major Pharma/MedTech companies (High investment projects).

- Category II: MSMEs and Startups (Early-stage innovation).

- Category III: Industry-Academia collaborations (To bridge the “lab-to-market” valley of death).

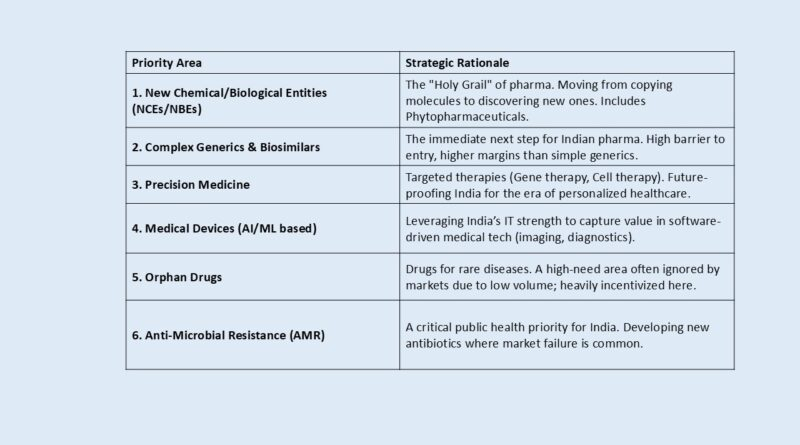

4. The Six Priority Areas (The “Target List”)

The scheme is not open to all R&D; it is strictly targeted at six high-impact domains. This targeting is a strength, preventing the dilution of funds across low-value improvements.

| Priority Area | Strategic Rationale |

|---|---|

| 1. New Chemical/Biological Entities (NCEs/NBEs) | The “Holy Grail” of pharma. Moving from copying molecules to discovering new ones. Includes Phytopharmaceuticals. |

| 2. Complex Generics & Biosimilars | The immediate next step for Indian pharma. High barrier to entry, higher margins than simple generics. |

| 3. Precision Medicine | Targeted therapies (Gene therapy, Cell therapy). Future-proofing India for the era of personalized healthcare. |

| 4. Medical Devices (AI/ML based) | Leveraging India’s IT strength to capture value in software-driven medical tech (imaging, diagnostics). |

| 5. Orphan Drugs | Drugs for rare diseases. A high-need area often ignored by markets due to low volume; heavily incentivized here. |

| 6. Anti-Microbial Resistance (AMR) | A critical public health priority for India. Developing new antibiotics where market failure is common. |

5. Financial Analysis & Incentives

The funding structure is nuanced to balance risk between the public and private sectors.

- For Startups/MSMEs (Early Stage):

- Support: Up to ₹5 Crore per project.

- Structure: High subsidy levels (up to 100% for the first ₹1 Cr) to de-risk the initial “proof of concept” phase where private VC money is scarce in India.

- For Established Industry (Later Stage):

- Support: Up to ₹100 Crore per project.

- Constraint: Capped at 35% of total project cost.

- Analysis: This ensures that large players have “skin in the game.” The government isn’t paying for the whole project but is subsidizing the risk enough to make the ROI attractive.

- Strategic Priority Innovations (SPI):

- For areas with low commercial viability but high health impact (e.g., Rare Diseases, AMR), funding support is increased to 50% of project cost. This functions as a “quasi-grant” to correct market failures.

6. Critical Analysis: Strengths vs. Challenges

Strengths

- Risk Capital Availability: For the first time, the Indian government is offering substantial risk capital for private sector R&D, moving beyond the traditional grant systems which were often too small (₹10-50 Lakhs) to matter for pharma.

- Academia-Industry Linkage: By explicitly incentivizing collaboration with government institutes (NIPERs/IITs), the scheme forces a breakdown of silos. Indian academia has historically been disconnected from commercial reality; PRIP creates a financial motive to collaborate.

- Focus on “Sunrise” Sectors: The inclusion of AI in medical devices and Cell/Gene therapy indicates forward-looking policy planning, rather than just supporting legacy chemical industries.

Challenges & Risks

- Budget Sufficiency: While ₹5,000 Cr is significant for India, it is modest globally. A single new drug can cost $1-2 Billion to bring to market. PRIP is a catalyst, not a replacement for private investment. It cannot fund Phase III global clinical trials, which are the most expensive part.

- Execution Speed: The success of PRIP depends on the “velocity of disbursement.” If the evaluation process (via the Empowered Committee) is bureaucratic and slow, the fast-moving nature of biotech innovation will render proposals obsolete before they are funded.

- IP Protection Regime: Innovation requires ironclad IP protection. While the scheme funds creation, the broader legal framework in India regarding patent enforcement remains a concern for global investors.

- Talent Gap: Funding buys equipment, but innovation needs specialized human capital (e.g., biologists trained in AI, clinical trial designers for gene therapy). The talent pool in these specific niches is currently thin in India.

7. Conclusion & Outlook

The PRIP scheme is a necessary and timely intervention. It acknowledges that India cannot remain a “volume player” forever as cost advantages erode.

- Short Term (1-2 Years): Expect a surge in patent filings from the startup ecosystem and increased utilization of NIPER facilities.

- Long Term (5-10 Years): Success will be measured not by the number of projects funded, but by the number of commercialized assets—specifically, if India can launch 2-3 global NCEs or Biosimilars that originated from this funding.

Recommendation for Stakeholders:

- Industry: Should utilize Component B not just for funding, but as a “quality stamp” to attract further private VC/PE investment.

- Investors: Should track PRIP beneficiaries as a curated deal-flow pipeline of high-potential biotech assets.

The “active window” for proposals in late 2025 signifies that the government is moving to the implementation phase. The industry’s response to this call will determine the trajectory of Indian pharma for the next decade.

PIB Release

Discover more from Simplified UPSC

Subscribe to get the latest posts sent to your email.