Food Processing and Related Industries in India

Contents

Food Processing and Related Industries in India

I. INTRODUCTION AND DEFINITION

The food processing industry encompasses the transformation of raw agricultural products into value-added food items through various techniques such as preservation, packaging, and preparation. This sector serves as a critical linkage between the agricultural sector and the consumer market, playing a fundamental role in reducing post-harvest losses, extending the shelf life of perishable goods, and enhancing the overall economic value of agricultural produce.

II. SCOPE AND SIGNIFICANCE OF FOOD PROCESSING INDUSTRIES

A. Economic Significance

Present Status:

India’s food processing industry is valued at USD 336.4 billion, making it the sixth largest globally

The sector contributes approximately 12% to India’s manufacturing GDP

It accounts for 8.8% of GVA in manufacturing and 8.39% in agriculture

Contributes 13% of India’s total exports and 6% of total industrial investment

Projected to reach USD 1,274 billion by 2027 (from USD 866 billion in 2022)

The average annual growth rate (AAGR) is approximately 7.26%

Employment Generation:

Employs over 1.9 million workers in 37,468 registered units

Has the potential to generate 9 million direct and indirect jobs by 2030

Food processing industry provides direct employment to more than 20 lakh people

B. Scope of Food Processing Industry

1. Raw Material Base:

India is the world’s 2nd largest producer of fruits and vegetables (after China)

1st in milk production globally

Largest producer of spices

1st in pulses production

50% of world’s buffalo population and 20% of cattle

Diverse crop variety provides steady supply of raw materials

2. Demand Potential:

Rising urbanization and changing dietary preferences driving consumption

Growing middle class with increasing purchasing power

Youth population and nuclear families creating demand for packaged foods

Expected packaged food sector to reach USD 30 billion by 2015 (now growing rapidly)

Growing consumption expected to reach USD 1.2 trillion by 2025-26

3. Export Opportunities:

India ranks 14th in global food exports with only 2% share (though significant potential exists)

Processed food exports reached USD 16.2 billion (2024-25) with 11.74% CAGR

Major exporting countries (USA, Netherlands, Germany) account for 43% of processed food exports

India’s agricultural exports reached USD 48.2 billion in FY24

4. Post-Harvest Loss Reduction:

India loses approximately 15-20% of total agricultural produce post-harvest

Approximately 74 million tonnes of food is lost annually (22% of foodgrain output or 10% of total production)

Perishable commodities face the highest losses: livestock produce (22%), fruits (19%), vegetables (18%)

Annual post-harvest losses cost farmers Rs 92,651 crore

5. Value Addition and Nutritional Enhancement:

Food processing allows for fortification and enrichment of foods

Diversification of food products by combining and modifying ingredients

Reduction of food waste through utilization of surplus or imperfect produce

Meeting consumer demands for innovative and convenient food products

III. CURRENT FOOD PROCESSING STATUS IN INDIA

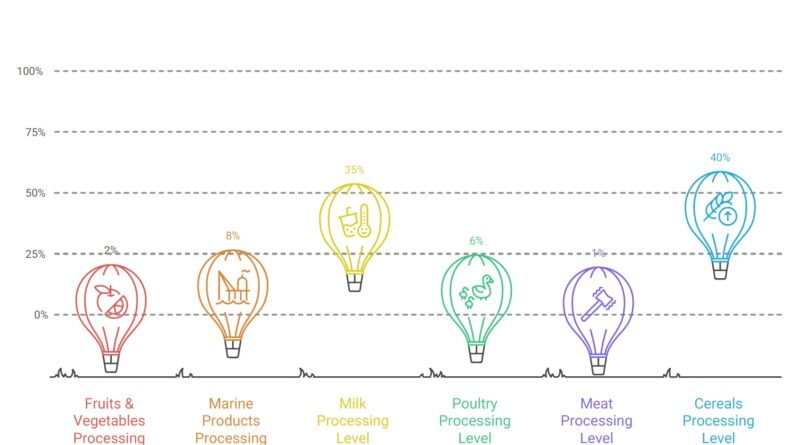

Despite India’s large production base, the processing levels remain significantly low:

| Commodity | Processing Level | Global Benchmark |

|---|---|---|

| Fruits & Vegetables | 2% | Higher in developed nations |

| Marine Products | 8% | Higher processing capacity needed |

| Milk | 35% | 37% overall dairy sector |

| Poultry | 6% | Significant growth potential |

| Meat | 1% | Very low despite large livestock base |

| Cereals | 40% of total processing | Primary processing dominates |

Key Challenge: More than 75% of the food processing industry remains in the unorganized sector

IV. MAJOR SEGMENTS OF FOOD PROCESSING INDUSTRY

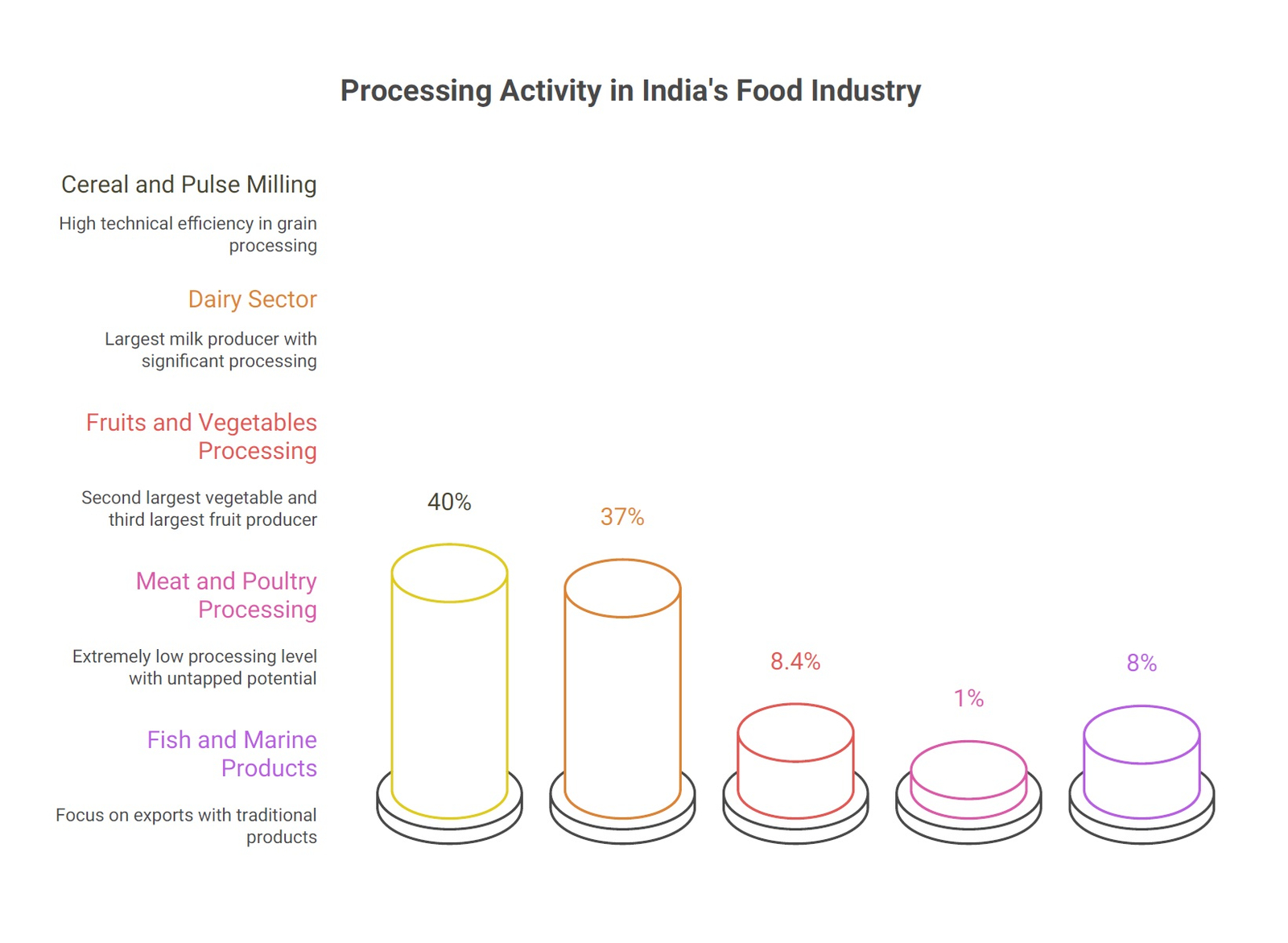

A. Cereal and Pulse Milling (Primary Processing)

Accounts for approximately 40% of total processing activity

Includes rice, sugar, edible oil, and flour mills

Grain processing with high technical efficiency

B. Dairy Sector (Largest Segment)

India is the world’s largest milk producer

37% of dairy yield is processed (largest proportion among all segments)

Organized sector processes approximately 15% of total milk production

Major products: milk powders, yogurt, cheese, butter, ghee

C. Fruits and Vegetables Processing

India is 2nd largest producer of vegetables and 3rd largest of fruits globally

Accounts for 8.4% of world’s food and vegetable yield

Processing techniques: canning, dehydration, pickling, bottling, freezing

Major products: juices, jams, pickles, dried fruits, frozen vegetables

D. Meat and Poultry Processing

India has largest livestock population globally (50% of world’s buffaloes)

Processing level extremely low: only 1% of total meat production converted to value-added products

Significant untapped potential in this segment

Major products: meat products, poultry items, processed meat

E. Fish and Marine Products

Current processing: 8% of production

Focus on exports to global markets

Traditional products: salted fish, dried fish, fishmeal

F. Other Segments

Beverages (coffee, tea, cocoa, soft drinks)

Bakery products (bread, biscuits)

Confectioneries and chocolates

Edible oils and fats

Breakfast cereals and fortified foods

Plant-based meat alternatives (emerging market)

V. LOCATIONAL FACTORS AND REGIONAL DISTRIBUTION

A. Factors Determining Location

1. Proximity to Raw Materials:

Industries processing bulk, low-value commodities (cereals, oilseeds) locate near production areas

Weight loss in processing (e.g., cotton ginning) makes raw material area location economical

2. Proximity to Markets:

Perishable products (bakery items, dairy products) require location close to consumer markets

Small processing units more market-sensitive than large ones

Large market centers offer better labour supply and lower distribution costs

3. Climate and Environmental Factors:

North-Western India advantages:

Cooler climates suitable for preserving food products

Lower humidity compared to peninsular and eastern India

Better conditions for storage infrastructure

Environmental regulations and waste handling capacity

4. Economic Factors:

Availability of cheap labor: Reduces operating costs significantly

Agricultural economy: Abundant raw materials at lower costs

Cost of production: 40% lower production costs in India compared to global averages

5. Infrastructure and Connectivity:

Road and rail connectivity for transportation

Proximity to ports for export-oriented industries

Water availability and management

B. Regional Distribution of Food Processing Industries

Southern Region – Leading Hub:

Houses the highest number of registered food processing factories

Andhra Pradesh: Approximately 14.3% of registered factories

Tamil Nadu: Significant concentration of food processing units

Telangana: Emerging as major processing hub

South region accounts for largest output share in food processing

North-Western Region – Primary Hub:

Punjab and Haryana: Historic centers for grain processing and dairy

Rajasthan: Growing agro-processing cluster

Uttar Pradesh: Major contributor to food processing capacity

State-wise Output Share (2023):

Madhya Pradesh: 22% (Pulses)

Maharashtra: 16.9% (Pulses)

Rajasthan: 13% (Pulses)

Uttar Pradesh: 12.3% (Pulses)

Gujarat: 7.7% (Pulses)

VI. UPSTREAM REQUIREMENTS (Pre-Processing Stage)

A. Raw Material Accessibility

Primary Requirement:

Easy availability of raw materials at lower costs

Established linkages with agricultural sectors

Access to diverse crop varieties for different processing needs

B. Modern Extraction and Processing Techniques

Adoption of advanced processing technologies

Implementation of modern machinery and equipment

Research and development for improved processing methods

C. Farmer Linkages

Importance:

Direct connection between farmers and processing units

Ensures sustainability and continuous raw material supply

Improves farmer income and incentivizes cultivation

Government Initiatives:

E-NAM (Electronic National Agriculture Market): Connects farmers directly with buyers

Farmer Producer Organizations (FPOs): Reduce dependency on middlemen

MSP (Minimum Support Price): Government support to farmers

D. Raw Material Storage Facilities

Critical Infrastructure:

Storage facilities for grains, meat, fish, and other commodities

Cold storage capacity for perishable items

Silos and warehousing infrastructure

Current Challenge:

Additional cold storage capacity needed: 3.5 million MT deficit exists

Under PMKSY’s Integrated Cold Chain Scheme: 268 out of 376 approved projects operationalized

Cold storage capacity created: 8.38 lakh MT (as of December 2022)

E. Quality Testing Facilities

Modern laboratories for food quality analysis

Standardization testing infrastructure

Certification capabilities for export standards

F. Transportation Infrastructure

Refrigerated vehicles for perishable transport

Road and rail networks connecting production to processing centers

Specialized refrigerated wagons for temperature-controlled transport

Adequate logistics and distribution networks

G. Workforce Development

Skilled and semi-skilled labor availability

Training and capacity building programs

Employment opportunities in rural areas

VII. DOWNSTREAM REQUIREMENTS (Post-Processing Stage)

A. Processing and Manufacturing

Key Functions:

Conversion of raw agricultural produce into processed food products

Maintenance of hygiene and quality standards during processing

Implementation of automation and advanced processing techniques

B. Storage and Warehousing

Infrastructure Components:

Modern cold storage and warehouse facilities to prevent spoilage

Inventory management systems to track stock levels

Reduction of wastage through proper storage management

Multiple-temperature controlled storage for diverse products

C. Packaging and Processing Equipment

High-quality packaging materials to maintain product integrity

Integrated Quick Freezing (IQF) and blast freezing technologies

Packing facilities for product preparation

Food preservation and modification technologies

D. Distribution and Retail Network

Supply Chain Coverage:

Efficient distribution to wholesalers and retailers

Supermarket and e-commerce platform access

Last-mile delivery to enhance consumer satisfaction

Growth Areas:

Online delivery platforms: BigBasket, Swiggy, Zomato

Organized retail expansion: Growing penetration in tier-2 and tier-3 cities

Direct-to-consumer models reducing middlemen

E. Quality Control and Regulatory Compliance

Standards and Certifications:

Adherence to FSSAI (Food Safety and Standards Authority of India) guidelines

Quality checks and certifications for international standards

Regular audits and inspections

FSSAI Inspection Framework (2025):

Grading system: A+ (Exemplar, 90+ marks), A (Satisfactory, 80-89 marks), B (Needs Improvement, 50-79 marks)

Assessment of hygiene, sanitation, staff hygiene, temperature control

Critical requirements marked with asterisks for non-negotiable compliance

VIII. SUPPLY CHAIN MANAGEMENT IN FOOD PROCESSING

A. Components of Food Supply Chain

1. Primary Stage – Farmer to Middleman:

Farmers produce agricultural commodities

Traditional middlemen connect farmers to processors

MSP policies influence farmer decisions

2. Processing Stage:

Raw material procurement and quality checking

Processing using appropriate techniques

Quality assurance and packaging

3. Storage and Distribution:

Warehousing and inventory management

Temperature-controlled transportation

Distribution to retailers and wholesalers

4. Retail to Consumer:

Final product reaching consumer through organized retail and e-commerce

Direct-to-consumer models gaining momentum

B. Key Challenges in SCM

Infrastructure Deficits:

Fragmented agricultural supply chain: Small-scale farmers lack direct market linkages

Poor cold storage infrastructure: Limited facilities result in spoilage of perishables

Inadequate transportation: Lack of refrigerated trucks and poor road connectivity

Operational Challenges:

Regulatory bottlenecks: Complex compliance processes hinder smooth operations

High logistics costs: Rising fuel prices and inefficient networks increase distribution costs

Limited technology adoption: Many SMEs do not use advanced SCM technologies

Inadequate pest control: Infestation and pathogens cause storage losses

C. Post-Harvest Losses – A Critical SCM Issue

Scale of Problem:

India loses Rs 1.53 trillion (USD 18.5 billion) annually from post-harvest losses

10-15% of overall food production lost to poor handling

Cereals loss: 4.44% (compared to China’s 2.22%)

Transit losses: 0.22% during distribution (2021-22)

Determinants of Loss:

Lack of proper storage facilities and cooling systems

Inappropriate packaging leading to physical damage and pest exposure

Limited market access resulting in delayed sales

Poor handling practices throughout supply chain

Inadequate knowledge and management capacity

D. Technology Integration in SCM

Emerging Solutions:

Blockchain: Enhanced traceability and transparency in supply chains

IoT (Internet of Things): Real-time monitoring of product conditions

AI and Analytics: Optimizing logistics routes and reducing costs

Automated warehousing: Improving inventory management and reducing errors

Digital supply chains: Farm-to-fork integration and reduced middlemen

E. Government Initiatives for SCM Improvement

1. Pradhan Mantri Kisan SAMPADA Yojana (PMKSY):

Outlay: Rs 10,900 crore (2021-27)

Components:

Mega Food Parks

Integrated cold chain and value addition infrastructure

Creation/expansion of food processing capacities

Infrastructure for agro-processing clusters

Food safety and quality assurance

Operation Greens scheme

Impact: Approved 41 Mega Food Parks, 353 cold chain projects, 63 agro-processing clusters

2. Integrated Cold Chain and Value Addition Infrastructure:

Grant-in-Aid: 35% for storage infrastructure (50% for NE/Himalayan states)

Components: Pre-cooling, sorting, grading, multi-temperature cold storage, IQF, blast freezing

Eligible Products: Horticulture, non-horticulture, fish/marine, dairy, meat, poultry

3. Operation Greens:

Focuses on Tomato, Onion, Potato (TOP) value chains

Provides subsidy on transportation and storage

As of 2022: 52 projects approved for value chain development

4. PM Formalisation of Micro Food Processing Enterprises (PMFME):

Supported close to 2 lakh micro enterprises over five years

Credit-linked subsidies and infrastructure creation

Transforms small enterprises into medium-sized operations

5. Production Linked Incentive (PLI) Scheme for Food Processing:

Budget: Rs 10,900 crore (2021-22 to 2026-27)

Target Products: RTC/RTE foods, millet-based products, processed fruits & vegetables, marine products

Investment Catalyzed: Rs 7,000 crore

Employment Generated: 2.5 lakh+ jobs (with 41 lakh tonnes capacity created)

Benefited Farmers: 9 lakh farmers

Project Support: 1,600+ projects funded across 213 locations

6. PLI Scheme for Millet-Based Products:

Outlay: Rs 800 crore (launched 2022-23)

Promotes sustainable and nutritious food alternatives

Utilizes FY 2022-23 savings from PLISFPI

IX. MEGA FOOD PARKS SCHEME

A. Objectives

Establish direct linkage from farm to processing to consumer markets

Increase processing of perishables from 6% to 20%

Increase India’s share in global food trade by 3% (by 2015)

Create modern infrastructure for food processing along the value chain

B. Scheme Highlights

Government Grant: Up to Rs 50 crores per food park to a consortium

Processing Units Expected: 30-35 units per park

Collective Investment: Minimum Rs 250 crores from consortium companies

Expected Turnover: Rs 400-500 crores per park

Employment Generation: 30,000 jobs per operational park; 5,000 directly

Farmer Connections: Each MFP expected to connect with 25,000 farmers

Quality Labs: Established at each food park

C. Operational Status

Total Approved: 42 Mega Food Parks sanctioned across India

Operational Parks (as of 2024):

Multiple parks now functional providing integrated processing infrastructure

Examples: Srini Mega Food Park (Chittoor, AP), Godavari Aqua Park (West Godavari, AP), North East Mega Food Park (Assam)

Major Operational Parks by State:

| State | Location | Focus |

|---|---|---|

| Andhra Pradesh | Chittoor, Bhimavaram, West Godavari | Dairy, Aqua processing |

| Assam | Nalbari | Diverse processing |

| Gujarat | Surat | Agricultural processing |

| Himachal Pradesh | Una | Horticultural products |

| Karnataka | Tumkur, Mandya | Integrated food processing |

| Maharashtra | Aurangabad, Satara | Multi-product processing |

| Odisha | Rayagada, Khurda | Marine and agro products |

| Punjab | Fazilka, Kapurthala | International standards |

| Rajasthan | Ajmer | Regional production |

| Telangana | Nizamabad, Khammam | Smart agro-processing |

| Uttarakhand | Haridwar, Udham Singh Nagar | Himalayan products |

| West Bengal | Jangipur | Regional specialties |

X. CHALLENGES IN FOOD PROCESSING SECTOR

A. Low Processing Levels

Only 2% of fruits and vegetables processed (vs. requirement of 20%)

Only 8% of marine products processed

Only 6% of poultry products processed

Only 1% of total meat converted to value-added products

Vast untapped potential in food processing

B. Post-Harvest Losses

Annual loss of Rs 92,651 crore due to inadequate infrastructure

Required investment for improvement: Rs 89,375 crore

Primary causes: poor storage and transportation facilities

C. Unorganized Sector Dominance

More than 75% of industry remains unorganized

Limited access to finance and technology

Lack of standardization and quality compliance

D. Infrastructure Gaps

Cold chain deficit: 3.5 million MT additional capacity needed

Inadequate cold storage facilities causing spoilage

Limited refrigerated transport infrastructure

Poor connectivity in rural production areas

E. Quality and Regulatory Compliance

Stringent FSSAI standards require significant investment

Complex compliance procedures for small and medium enterprises

Frequent regulatory updates requiring continuous adaptation

International certification requirements for exports

F. Export Market Challenges

India holds only 2% of global food export market

Top 5 exporting nations control 34% of global share

Most exports directed to Indian diaspora (limited market diversification)

Need for building global brand recognition

G. Technology and Innovation Gaps

Limited adoption of advanced processing technologies in SMEs

Low investment in R&D relative to global competitors

Digital transformation still in nascent stages

Inadequate focus on value-added products

XI. GOVERNMENT POLICY FRAMEWORK

A. Regulatory Framework

Food Safety and Standards Act (FSSA), 2006:

Enforced by Food Safety and Standards Authority of India (FSSAI)

Covers food product specifications, packaging, labeling, hygiene standards

Stringent contaminant and pesticide residue limits

Certification and Standards:

AGMARK (Agricultural Mark) for agricultural products

ISO standards for quality management

Import certifications with rigorous testing protocols

B. Major Government Initiatives

1. Pradhan Mintri Kisan SAMPADA Yojana (PMKSY):

Umbrella scheme for comprehensive food processing support

Budget: Rs 10,900 crore (2021-27)

2. Production Linked Incentive (PLI) Scheme:

Budget: Rs 10,900 crore

Supports manufacturing and innovation in food processing

3. PM Formalisation of Micro Food Processing (PMFME):

Promotion of unorganized sector formalization

Credit-linked subsidies and infrastructure support

4. Pradhan Mantri Matsya Sampada Yojana (PMSSY):

Investment: Rs 20,050 crore

Focus on fisheries cold chain and post-harvest infrastructure

Target: Enhance fish production to 22 million MT

XII. EXPORT POTENTIAL AND OPPORTUNITIES

A. Current Export Status

Processed food exports: USD 16.2 billion (2024-25)

Growth rate: 11.74% CAGR

Agricultural exports: USD 48.2 billion (FY24)

Global market share: 2% only (significant growth potential)

B. Export Opportunities

1. Value Addition Potential:

Moving from primary commodities to value-added products

Scaling healthy Indian food products (millets, makhana)

GI-tagged products gaining global recognition

Herbal and natural product exports

2. Product Categories:

Spices and condiments

Dairy products

Processed fruits and vegetables

Marine and seafood products

Millet-based products

Chocolate and confectionery

3. Global Market Access:

USA, Netherlands, Germany as major markets

Top 10 global markets account for 53% of imports

Emerging demand for clean-label, protein-rich, gut-friendly foods

C. Competitive Advantages

Cost advantage: 40% lower production costs

Large labor force: Abundant low-cost skilled workforce

Strategic location: Proximity to Asian markets and export-importing regions

Diverse production base: Global competitiveness across multiple segments

XIII. EMPLOYMENT AND RURAL DEVELOPMENT

A. Employment Generation

Direct employment: 1.9 million workers in registered units

Potential employment: 9 million by 2030

PLI Scheme: 2.5 lakh+ jobs created

PMKSY: 13.09 lakh people employed

PMFME: Significant rural employment generation

B. Rural Development Impact

Income Enhancement:

Direct farmer income improvement through value addition

Reduced post-harvest losses increasing farmer returns

Better price realization through farmer linkages

Infrastructure Development:

Establishment of processing units in agricultural areas

Creation of rural infrastructure through mega food parks

Cold chain development in remote regions

Livelihood Opportunities:

Employment in processing, packaging, distribution

Skill development and training opportunities

Entrepreneurship through PMFME and related schemes

XIV. KEY PERFORMANCE INDICATORS (UPSC Mains Context)

| Indicator | Current Value | Significance |

|---|---|---|

| Industry Size | USD 336.4 billion | 6th largest globally |

| Contribution to Manufacturing GDP | 12% | Major economic sector |

| Employment | 1.9 million registered | Significant job provider |

| Processing Level (F&V) | 2% | Indicates huge growth potential |

| Export Value | USD 16.2 billion | Growing export competitiveness |

| AAGR | 7.26% | Strong sector growth |

| Projected Size (2027) | USD 1,274 billion | Doubling from 2022 |

| Post-Harvest Loss | Rs 92,651 crore annually | Critical challenge |

| Cold Storage Deficit | 3.5 million MT | Infrastructure need |

XV. FUTURE PROSPECTS AND RECOMMENDATIONS

A. Growth Drivers

Rising middle-class consumption

Urbanization and changing food preferences

Digital platform growth (e-commerce, online delivery)

Government policy support through multiple schemes

Export demand for value-added products

B. Strategic Recommendations for Growth

1. Infrastructure Development:

Expand cold chain capacity by 3.5 million MT

Improve transportation and logistics networks

Establish agro-processing clusters in production zones

2. Technology Integration:

Promote blockchain, IoT, and AI adoption

Support automation in SMEs

Digital supply chain implementation

3. Export Promotion:

Building global brand recognition

Focus on clean-label and health-conscious products

Diversify export markets beyond diaspora markets

4. Skill Development:

Training programs for workforce upskilling

Formalizing unorganized sector

5. Regulatory Harmonization:

Streamline FSSAI compliance procedures

Align with international food safety standards

XVI. QUICK REVISION POINTS FOR UPSC

Definition: Conversion of raw agricultural products into value-added food items through preservation, packaging, and processing techniques.

Scale: 6th largest globally; 12% of India’s manufacturing GDP; USD 336.4 billion valued.

Significance: Reduces post-harvest losses (15-20%), provides rural employment (1.9 million), generates exports (USD 16.2 billion), ensures food security.

Location Factors: Proximity to raw materials (North-West), markets (urban centers), climate (cool regions), and infrastructure.

Upstream: Raw material accessibility, farmer linkages, cold storage, testing facilities, transport, workforce.

Downstream: Processing, packaging, warehousing, distribution, quality control, retail networks.

Supply Chain: Farm to consumer journey involving sourcing, processing, storage, distribution stages; challenged by fragmented agriculture, poor cold chain, high costs.

Challenges: Low processing levels (2% F&V), 75% unorganized sector, post-harvest losses (Rs 92,651 crore annually), cold chain deficit, regulatory compliance costs.

Government Schemes: PMKSY (Rs 10,900 crore), PLI (generating 2.5 lakh jobs), PMFME (2 lakh enterprises supported), PMSSY (fisheries focus).

Mega Food Parks: 42 sanctioned; provide integrated infrastructure, connect 25,000 farmers per park, generate 30,000 jobs per park.

Export Potential: 2% global share (USD 16.2 billion); opportunity to move to value-added products and diverse markets; 40% cost advantage.

Employment: 1.9 million current; 9 million potential by 2030; significant rural development impact.

UPSC MAINS QUESTIONS

2025 – UPSC Mains

Q1. Elaborate the scope and significance of supply chain management of agricultural commodities in India. (10 Marks, 150 Words)

Q2. Examine the scope of the food processing industries in India. Elaborate the measures taken by the government in the food processing industries for generating employment opportunities. (15 Marks, 250 Words)

2024 – UPSC Mains

Q. What are the major challenges faced by Indian irrigation system in recent times? State the measures taken by the government for efficient irrigation management. (Related to agricultural infrastructure)

2023 – UPSC Mains

Q1. How does e-Technology help farmers in production and marketing of agricultural produce? Explain it. (10 Marks)

Q2. Explain the changes in cropping pattern in India in the context of changes in consumption pattern and marketing conditions. (10 Marks)

Q3. Discuss the significance of essential upstream and downstream requirements in ensuring a robust and sustainable food processing industry. (10 Marks, 150 Words)

2022 – UPSC Mains

Q1. Elaborate the scope and significance of the food processing industry in India. (10 Marks, 150 Words)

Q2. What are the main bottlenecks in the upstream and downstream process of marketing of agricultural products in India? (15 Marks, 250 Words)

2020 – UPSC Mains

Q. What are the challenges and opportunities of the food processing sector in the country? How can income of the farmers be substantially increased by encouraging food processing? (10 Marks, 150 Words)

2019 – UPSC Mains

Q1. How far is Integrated Farming System (IFS) helpful in sustaining agricultural production? (10 Marks)

Q2. What are the reformative steps taken by the Government to make the food grain distribution system more effective? (15 Marks)

Q3. Elaborate the policy taken by the Government of India to meet the challenges of the food processing sector. (15 Marks, 250 Words)

2018 – UPSC Mains

Q1. What do you mean by Minimum Support Price (MSP)? How will MSP rescue the farmers from the low-income trap? (10 Marks)

Q2. Examine the role of supermarkets in supply chain management of fruits, vegetables, and food items. How do they eliminate the number of intermediaries? (10 Marks, 150 Words)

Q3. Assess the role of the National Horticulture Mission (NHM) in boosting the production, productivity, and income of horticulture farms. How far has it succeeded in increasing the income of farmers? (15 Marks, 250 Words)

2017 – UPSC Mains

Q1. Explain various types of revolutions that took place in agriculture after Independence in India. How have these revolutions helped in poverty alleviation and food security in India? (10 Marks)

Q2. What are the reasons for poor acceptance of cost-effective small processing units? How can the food processing unit be helpful to uplift the socio-economic status of poor farmers? (10 Marks, 150 Words)

Q3. How do subsidies affect the cropping pattern, crop diversity, and economy of farmers? What is the significance of crop insurance, minimum support price, and food processing for small and marginal farmers? (15 Marks, 250 Words)

2016 – UPSC Mains

Q. What are the impediments in marketing and supply chain management in developing the food processing industry in India? Can e-commerce help in overcoming these bottlenecks? (12.5 Marks, 250 Words)

2015 – UPSC Mains

Q. What are the impediments in marketing and supply chain management in developing the food processing industry in India? Can e-commerce help in overcoming this bottleneck? (12.5 Marks, 250 Words)

2013 – UPSC Mains

Q. India needs to strengthen measures to promote the pink revolution in food industry for ensuring better nutrition and health. Critically elucidate the statement. (15 Marks, 250 Words)

AGRICULTURE AND FOOD PROCESSING

Discover more from Simplified UPSC

Subscribe to get the latest posts sent to your email.