Centre-State Relations in India

Contents

Centre-State Relations in India:

Introduction

The Constitution of India, being federal in structure, divides all powers—legislative, executive, and financial—between the Centre and the states. However, there is no division of judicial power as the Constitution has established an integrated judicial system to enforce both Central laws as well as state laws.

Though the Centre and states are supreme in their respective fields, maximum harmony and coordination between them is essential for the effective operation of the federal system. The Constitution contains elaborate provisions to regulate the various dimensions of relations between the Centre and states, which can be studied under three heads: Legislative Relations, Administrative Relations, and Financial Relations.

Legislative Relations (Articles 245-255)

Articles 245 to 255 in Part XI of the Constitution deal with legislative relations between the Centre and states. The Constitution divides legislative powers between the Centre and states with respect to both territory and subjects of legislation.

1. Territorial Extent of Central and State Legislation

Parliamentary Powers:

Parliament can make laws for the whole or any part of India’s territory, including states, union territories, and any other area included in India’s territory

Parliament alone can make extra-territorial legislation, applicable to Indian citizens and their property worldwide

State Legislature Powers:

State legislatures can make laws for the whole or any part of the state

Laws made by state legislatures are not applicable outside the state, except when there is sufficient nexus between the state and the object

Restrictions on Parliamentary Jurisdiction:

President can make regulations for Andaman and Nicobar Islands, Lakshadweep, Dadra and Nagar Haveli, and Daman and Diu

Governor can direct that Parliament acts don’t apply to scheduled areas or apply with modifications

Governor of Assam and President (for Meghalaya, Tripura, Mizoram) can direct non-application in tribal areas

2. Distribution of Legislative Subjects

The Constitution provides a three-fold distribution through the Seventh Schedule:

Union List (List-I):

Parliament has exclusive powers

Currently has 100 subjects (originally 97) including defence, banking, foreign affairs, currency, atomic energy, insurance, communication, inter-state trade and commerce

State List (List-II):

State legislature has exclusive powers in normal circumstances

Currently has 61 subjects (originally 66) including public order, police, public health and sanitation, agriculture, prisons, local government, fisheries, markets

Concurrent List (List-III):

Both Parliament and state legislatures can legislate

Currently has 52 subjects (originally 47) including criminal law and procedure, civil procedure, marriage and divorce, population control, electricity, labour welfare, economic and social planning, drugs, newspapers

The 42nd Amendment Act of 1976 transferred five subjects to Concurrent List from State List: education, forests, weights and measures, protection of wild animals and birds, and administration of justice

Residuary Powers:

Vested in Parliament, including power to levy residuary taxes

Hierarchy in Case of Conflicts:

Union List prevails over both State List and Concurrent List

Concurrent List prevails over State List

In Concurrent List conflicts, Central law prevails over state law unless the state law has received Presidential assent (then Parliament can still override subsequently)

3. Parliamentary Legislation in the State Field

Parliament can make laws on State List subjects under five extraordinary circumstances:

a) When Rajya Sabha Passes a Resolution (Article 249):

If Rajya Sabha declares it necessary in national interest with two-thirds majority

Resolution remains valid for one year, renewable

Laws cease after six months of resolution expiry

b) During National Emergency (Article 250):

Parliament can legislate on State List matters during national emergency

Laws become inoperative six months after emergency ends

c) When States Make a Request (Article 252):

When two or more state legislatures pass resolutions requesting Parliament to legislate

Law applies only to requesting states (others can adopt later)

Only Parliament can amend or repeal such laws

Examples: Prize Competition Act 1955, Wildlife Protection Act 1972, Water Pollution Act 1974, Urban Land Ceiling Act 1976, Transplantation of Human Organs Act 1994

d) To Implement International Agreements (Article 253):

Parliament can legislate on State List to implement international treaties, agreements, or conventions

Examples: United Nations Privileges and Immunities Act 1947, Geneva Convention Act 1960, Anti-Hijacking Act 1982, TRIPS legislation

e) During President’s Rule (Article 356):

Parliament can legislate on State List for that state

Such laws continue even after President’s Rule ends but can be repealed by state legislature

4. Centre’s Control Over State Legislation

Governor can reserve state bills for Presidential consideration (absolute veto)

Bills on certain State List matters require prior Presidential sanction

During financial emergency, President can direct reservation of money bills and financial bills

Administrative Relations (Articles 256-263)

Articles 256 to 263 deal with administrative relations between Centre and states, along with other provisions.

1. Distribution of Executive Powers

Executive power is divided on lines similar to legislative powers:

Centre’s executive power extends to: Union List subjects and exercise of rights from treaties/agreements

State’s executive power extends to: State List subjects within its territory

For Concurrent List: Executive power rests with states unless Constitution or Parliamentary law confers it on Centre

2. Obligations of States and Centre’s Directions

Two Constitutional Restrictions on States (Article 256-257):

States must ensure compliance with Parliamentary laws and existing applicable laws

States must not impede or prejudice Centre’s executive power

Non-compliance allows President to invoke Article 356 (President’s Rule)

Centre Can Give Directions to States For:

Construction and maintenance of nationally/militarily important communication means

Measures for railway protection

Adequate mother-tongue instruction facilities for linguistic minorities at primary stage

Drawing up and executing schemes for Scheduled Tribes welfare

3. Mutual Delegation of Functions

With State’s Consent:

President may entrust Centre’s executive functions to state government

Governor may entrust state’s executive functions to Central government

Can be conditional or unconditional

Without State’s Consent:

Parliament can confer powers and impose duties on states through Union List legislation

States cannot do the same to Centre

4. Cooperation Between Centre and States

Constitutional provisions for cooperation:

Parliament can adjudicate inter-state river water disputes

President can establish Inter-State Council (established in 1990 under Article 263)

Full faith and credit to public acts, records, and judicial proceedings throughout India

Parliament can appoint authority for interstate freedom of trade and commerce

5. All-India Services

Three All-India Services exist:

Indian Administrative Service (IAS) – replaced Indian Civil Service in 1947

Indian Police Service (IPS) – replaced Indian Police in 1947

Indian Forest Service (IFS) – created in 1966

Key Features:

Members serve both Centre and states by turns

Recruited and trained by Centre

Jointly controlled by Centre and states (ultimate control with Centre, immediate control with states)

Article 312 authorizes Parliament to create new All-India Services based on Rajya Sabha resolution

Justification: Despite violating federalism principles, All-India Services help maintain high administrative standards, ensure uniformity, and facilitate Centre-state cooperation.

6. Public Service Commissions

Centre-State Relations in PSCs:

State PSC Chairman and members appointed by Governor but removed only by President

Parliament can establish Joint State Public Service Commission (JSPSC) for two or more states

UPSC can serve states on request with Presidential approval

UPSC assists states in framing joint recruitment schemes

7. Integrated Judicial System

Despite dual polity, India has single integrated judicial system:

Supreme Court at top, state high courts below

System enforces both Central and state laws

High court judges appointed by President in consultation with CJI and Governor

President can transfer and remove high court judges

Parliament can establish common high court for multiple states (e.g., Maharashtra-Goa, Punjab-Haryana)

8. Relations During Emergencies

During National Emergency (Article 352):

Centre can give executive directions to states on any matter

State governments remain but under complete Central control

During President’s Rule (Article 356):

President assumes state government functions and Governor’s powers

Authority over police, law and order, bureaucratic transfers transferred to Centre

During Financial Emergency (Article 360):

Centre can direct states on financial propriety canons

President can reduce salaries of state servants and high court judges

9. Extra-Constitutional Devices

Advisory Bodies:

Planning Commission (now replaced by NITI Aayog)

National Development Council

National Integration Council

Zonal Councils

North-Eastern Council

Central councils for various sectors (Health, Local Government, Medicine, etc.)

Important Conferences:

Governors’ conference (presided by President)

Chief Ministers’ conference (presided by Prime Minister)

Chief Secretaries’ conference (presided by Cabinet Secretary)

Inspector-General of Police conference

Chief Justices’ conference

Vice-Chancellors’ conference

Home Ministers’ conference

Law Ministers’ conference

Financial Relations (Articles 268-293)

Articles 268 to 293 in Part XII deal with Centre-state financial relations.

1. Allocation of Taxing Powers

Distribution of Taxation Powers:

Parliament: Exclusive power on 15 subjects in Union List

State Legislature: Exclusive power on 20 subjects in State List

Both: Can levy taxes on 3 subjects in Concurrent List

Residuary taxation power: Vested in Parliament

Restrictions on State Taxing Powers:

Professional tax limit: Maximum Rs. 2,500 per annum (raised from Rs. 250 by 60th Amendment 1988)

Sales tax: Cannot be imposed on inter-state trade, imports/exports, or outside state

Electricity tax: Cannot tax electricity consumed/sold to Centre or for railway purposes

Water/electricity from inter-state projects: Requires Presidential assent after reservation

2. Distribution of Tax Revenues

Recent Changes (80th and 88th Amendments):

The 80th Amendment (2000) and 88th Amendment (2003) significantly altered tax revenue distribution:

A. Taxes Levied by Centre but Collected and Appropriated by States (Article 268):

Stamp duties on bills of exchange, cheques, promissory notes, insurance policies, share transfers

Excise duties on medicinal and toilet preparations with alcohol/narcotics

Proceeds don’t form part of Consolidated Fund of India

B. Service Tax (Article 268-A):

Levied by Centre but collected and appropriated by both Centre and states

Principles formulated by Parliament

C. Taxes Levied and Collected by Centre but Assigned to States (Article 269):

Taxes on inter-state sale/purchase of goods (except newspapers)

Taxes on inter-state consignment of goods

Net proceeds assigned to concerned states per Parliamentary principles

D. Taxes Levied and Collected by Centre but Distributed (Article 270):

All taxes except those in Articles 268, 268-A, 269, surcharges under Article 271, and specific purpose cesses

Distributed per Finance Commission recommendations

E. Surcharge for Centre (Article 271):

Parliament can levy surcharges on taxes in Articles 269 and 270

Proceeds go exclusively to Centre, states get no share

F. Taxes Levied, Collected, and Retained by States:

20 categories including land revenue, agricultural income tax, succession and estate duties on agricultural land, various other taxes

States’ exclusive revenue

3. Distribution of Non-Tax Revenues

Centre’s Sources:

Posts and telegraphs, railways, banking, broadcasting, coinage and currency, central public sector enterprises, escheat and lapse

States’ Sources:

Irrigation, forests, fisheries, state public sector enterprises, escheat and lapse

4. Grants-in-Aid to States

Statutory Grants (Article 275):

Made to states needing financial assistance (not all states)

Different sums for different states

Charged on Consolidated Fund of India

Includes general grants and specific grants for Scheduled Tribes/Areas welfare

Given on Finance Commission recommendations

Discretionary Grants (Article 282):

Both Centre and states can make grants for any public purpose

Centre makes grants on Planning Commission recommendations (now NITI Aayog)

Two-fold purpose: help states meet plan targets and give Centre leverage to coordinate state action

Form larger part of Central grants compared to statutory grants

Other Grants:

Previously provided for grants in lieu of export duties on jute products to Assam, Bihar, Orissa, West Bengal (for 10 years from Constitution commencement)

5. Finance Commission

Constituted every fifth year or earlier under Article 280:

Mandate:

Recommend distribution of net tax proceeds between Centre and states

Recommend principles for grants-in-aid from Consolidated Fund of India

Recommend measures to augment Consolidated Fund of states for panchayats and municipalities (added by 73rd and 74th Amendments)

Any other matter referred by President

Recent Developments:

15th Finance Commission (2021-26):

Recommended 41% vertical devolution of central taxes to states (down from 42% to adjust for J&K and Ladakh UTs creation)

Fiscal roadmap: Centre to reduce fiscal deficit to 4% of GDP by 2025-26

States’ fiscal deficit limits: 4% of GSDP in 2021-22, 3.5% in 2022-23, 3% during 2023-26

Recommended grants of ₹4.36 lakh crore to local bodies

Performance-based incentives: ₹45,000 crore for agricultural reforms, ₹4,800 crore for education outcomes

Recommended independent Fiscal Council, review of FRBM Act

Recommended establishment of All India Medical and Health Service

16th Finance Commission (2026-31):

Constituted on December 31, 2023, chaired by Dr. Arvind Panagariya

Initially due October 31, 2025, extended to November 30, 2025

Submitted report to President on November 16, 2025

Will be tabled in Parliament by Finance Minister

Covers five-year period from April 1, 2026 to March 31, 2031

6. Protection of States’ Interests

Following bills require Presidential recommendation:

Bills imposing or varying taxes in which states are interested

Bills varying “agricultural income” definition for income tax

Bills affecting money distribution principles to states

Bills imposing surcharge on specified taxes/duties for Centre

“Tax or duty in which states are interested” means:

Tax/duty whose net proceeds (wholly or partly) assigned to states

Tax/duty whose net proceeds determine sums payable to states from Consolidated Fund of India

Net proceeds: Tax/duty proceeds minus collection cost, certified by CAG (final)

7. Borrowing Powers

Central Government:

Can borrow within India or abroad on Consolidated Fund security

Can give guarantees within Parliamentary limits

State Government:

Can borrow only within India on Consolidated Fund of State security

Can give guarantees within state legislature limits

Cannot raise loans without Centre’s consent if Central loans/guarantees are outstanding

Central Loans to States:

Centre can make loans to states or give guarantees

Sums charged on Consolidated Fund of India

8. Inter-Governmental Tax Immunities

Centre’s Property Exemption:

Central property exempt from all state/local authority taxes

Parliament can remove this ban

Includes all property types (movable/immovable, tangible/intangible) for sovereign or commercial purposes

Note: Central corporations/companies are not exempt (separate legal entities)

State’s Property/Income Exemption:

State property and income exempt from Central taxation (sovereign or commercial functions)

Centre can tax state’s commercial operations if Parliament provides

Parliament can declare particular trade/business incidental to ordinary government functions (then not taxable)

Note: Local authority property/income and state-owned corporations/companies not exempt

Important Exception:

Supreme Court (1963 advisory opinion): State immunity doesn’t extend to customs or excise duties

9. Effects of Emergencies

During National Emergency (Article 352):

President can modify constitutional revenue distribution

Can reduce or cancel transfers (tax sharing and grants) from Centre to states

Modifications continue till end of financial year in which emergency ceases

During Financial Emergency (Article 360):

Centre can direct states to: observe specified financial propriety canons, reduce salaries/allowances of all state servants including high court judges, reserve all money and financial bills for Presidential consideration

Trends and Issues in Centre-State Relations

Evolution of Centre-State Relations

1947-1967: Smooth relations due to one-party (Congress) rule at Centre and most states

1967 onwards: Changed political scenario with Congress defeats in nine states led to:

Opposition to increasing centralization

Demands for state autonomy

Increased powers and financial resources for states

Tensions and conflicts between Centre and states

Tension Areas

The following issues created tensions between Centre and states:

Mode of appointment and dismissal of Governors

Discriminatory and partisan role of Governors

Imposition of President’s Rule for partisan interests

Deployment of Central forces in states for law and order

Reservation of state bills for Presidential consideration

Discrimination in financial allocations

Role of Planning Commission in approving state projects

Management of All-India Services (IAS, IPS, IFS)

Use of electronic media for political purposes

Appointment of enquiry commissions against Chief Ministers

Sharing of finances between Centre and states

Encroachment by Centre on State List

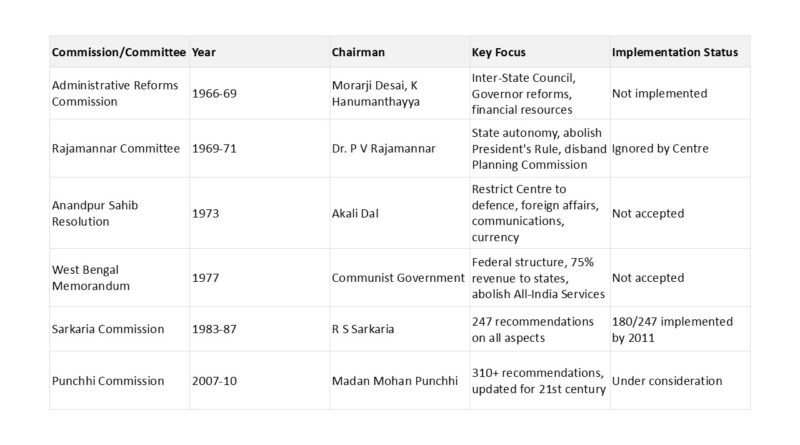

Various Commissions and Recommendations

1. Administrative Reforms Commission (1966-69)

Under Morarji Desai, later K Hanumanthayya. Important recommendations:

Establish Inter-State Council under Article 263

Appoint experienced, non-partisan persons as Governors

Delegate maximum powers to states

Transfer more financial resources to states

Deploy Central armed forces on states’ request or otherwise

No action was taken on ARC recommendations

2. Rajamannar Committee (1969-71)

Tamil Nadu Government committee under Dr. P V Rajamannar. Key recommendations:

Set up Inter-State Council immediately

Make Finance Commission permanent

Disband Planning Commission, replace with statutory body

Omit Articles 356, 357, 365 (President’s Rule)

Remove provision that state ministry holds office during Governor’s pleasure

Transfer certain Union and Concurrent List subjects to State List

Allocate residuary powers to states

Abolish All-India Services

Central government completely ignored recommendations

3. Anandpur Sahib Resolution (1973)

Akali Dal resolution demanded:

Centre’s jurisdiction restricted to defence, foreign affairs, communications, currency

Entire residuary powers vested in states

Real federal Constitution with equal authority and representation to all states

4. West Bengal Memorandum (1977)

Communist-led West Bengal Government suggested:

Replace “union” with “federal” in Constitution

Centre’s jurisdiction confined to defence, foreign affairs, currency, communications, economic coordination

All other subjects including residuary vested in states

Repeal Articles 356, 357, 360

Make states’ consent obligatory for state reorganization

Allocate 75% of total Central revenue to states

Give Rajya Sabha equal powers with Lok Sabha

Abolish All-India Services, have only Central and State services

Central government did not accept demands

5. Sarkaria Commission (1983-87)

Under R S Sarkaria (retired Supreme Court judge). 247 recommendations, important ones:

On Constitutional Arrangements:

Set up permanent Inter-Governmental Council under Article 263

Use Article 356 very sparingly, as last resort

Strengthen All-India Services, create more such services

Continue residuary taxation powers with Parliament; place other residuary powers in Concurrent List

Communicate reasons when President withholds assent to state bills

Rename NDC as National Economic and Development Council (NEDC)

Reactivate Zonal Councils

On Governor and Administration:

Prescribe Chief Minister consultation in Governor appointment in Constitution itself

Governor’s five-year term should not be disturbed except for compelling reasons

Governor cannot dismiss Council of Ministers if it commands majority

No enquiry commission against state minister unless Parliament demands

Centre can deploy armed forces even without states’ consent (desirable to consult)

On Legislative Relations:

Consult states before making Concurrent List laws

Continue present Finance Commission-Planning Commission function division

Net proceeds of corporation tax may be made shareable with states

Centre should not levy income tax surcharge except for specific purpose and limited period

On Federal Character:

Implement three-language formula uniformly in true spirit

No autonomy for radio/television but decentralize operations

No change in Rajya Sabha role and Centre’s power to reorganize states

Activate Commissioner for Linguistic Minorities

Implementation: Till December 2011, 180 out of 247 recommendations implemented. Most important: establishment of Inter-State Council in 1990.

6. Punchhi Commission (2007-10)

Second Centre-State Relations Commission under Madan Mohan Punchhi (former CJI). Over 310 recommendations:

On Legislative Relations:

Broad Centre-state agreement before introducing Concurrent List legislation in Parliament

Centre should be extremely restrained in asserting Parliamentary supremacy on State List matters

Centre should occupy only absolutely necessary subjects in concurrent/overlapping jurisdiction for uniformity

Continuing auditing role for Inter-State Council in concurrent/overlapping jurisdiction management

Six-month period for state legislature under Article 201 should apply to President also

Parliament should make law on treaty-making and implementation (Entry 14, List I)

Financial obligations from treaties should be permanent Finance Commission reference term

On Governor’s Role:

Adopt strict Sarkaria Commission guidelines for Governor selection

Give Governors fixed five-year tenure, removal not at Centre’s will

Apply President’s impeachment procedure (mutatis mutandis) to Governors

Article 163 doesn’t give Governor general discretionary power against Council of Ministers advice

Governor should decide on bills within six months (assent or Presidential reservation)

Clear guidelines for Chief Minister appointment in hung assembly situations

Governor should insist on floor test with time limit before dismissing Chief Minister

Governor can sanction prosecution of state minister against Cabinet advice if decision appears biased

End convention of Governors as University Chancellors

On Article 356:

Exhaust all alternatives before invoking Article 356

Amend Constitution to incorporate S.R. Bommai judgment guidelines

Provide Constitutional/legal framework for “localized emergency” under Article 355

On Institutional Mechanisms:

Amend Article 263 to make Inter-State Council credible, powerful, fair

Zonal Councils should meet twice yearly

Institutionalize Empowered Committee model in other sectors

Forum of Chief Ministers chaired by CM by rotation for sectors like energy, food, education

Create new All-India Services in health, education, engineering, judiciary

On Rajya Sabha:

Remove factors inhibiting Rajya Sabha as representative forum of states

Give equality of representation to all states in Rajya Sabha irrespective of population

On Financial Relations:

Define scope of local body power devolution constitutionally

All future Central legislations involving states should provide cost-sharing

Revise royalty rates on major minerals every three years

Remove ceiling on profession tax completely

Review scope for raising revenue from Article 268 taxes

Better Centre-state coordination in Finance Commission ToR finalization

Review existing cesses and surcharges to reduce their share

Appoint expert committee on plan/non-plan expenditure distinction

Synchronize Finance Commission and Five-Year Plan periods

Convert Finance Commission division to full-fledged department

Planning Commission role should be coordination, not micro-managing

On Other Matters:

Set up Inter-State Trade and Commerce Commission under Article 307

Provide adequate compensation to states for delay in royalty revision beyond three years

Annual assessment of fiscal legislation by independent body

Recent Developments and Changes (2019-2025)

A. Constitutional and Legal Changes

1. Abrogation of Article 370 (August 5, 2019)

Background:

Article 370 granted special status to Jammu and Kashmir with power to have separate constitution, state flag, and autonomy of internal administration

Only three subjects initially under Centre: defence, foreign affairs, and communications

Changes Made:

Presidential Order C.O. 272 (August 5, 2019) applied all Constitutional provisions to J&K

Article 370 rendered inoperative, separate J&K Constitution abrogated

Jammu and Kashmir Reorganisation Act, 2019 passed

New Structure:

Union Territory of Jammu & Kashmir: With legislature

Union Territory of Ladakh: Without legislature (directly administered by President)

Both came into existence on October 31, 2019 (National Unity Day)

Lt. Governors appointed for both UTs by President

Supreme Court Verdict (2023):

Upheld abrogation of Article 370 and C.O. 272, 273

Held J&K had no internal sovereignty but was feature of asymmetric federalism

Left statehood restoration issue unanswered, noting Centre’s assurance to restore statehood soon

Current Status:

Extensive powers granted to Lt. Governor under J&K Reorganisation Act

Home Minister of India effectively controls Police and bureaucracy in both UTs

Strong political push for statehood restoration continues

2. Implementation of GST (Goods and Services Tax)

Constitutional Amendment (101st Amendment, 2016):

Introduced to change tax structure and introduce GST

Empowered Centre and states to levy and collect GST

Inserted Article 246A, 269A in Constitution

Added Entry 92-C (taxes on services) in Union List

Fundamental Shift in Financial Relations:

Dual GST system: Both Centre and states levy GST simultaneously

CGST (Central GST): On intra-state transactions

SGST (State GST): On intra-state transactions

IGST (Integrated GST): On inter-state transactions

GST Council:

Joint Constitutional forum for Centre and states

Comprises Union Finance Minister, Minister of State for Finance, and Finance Ministers of all states

2/3rd majority required for decisions

Decides tax rates, exemptions, administration

Features of Cooperative Federalism:

Harmonization of GST laws across country despite separate Centre and state Acts

Single interface for taxpayers with one tax authority (either Centre or State)

Cross-authorization of officers under both CGST and SGST Acts

Joint Implementation Committees with Centre-state representation

Three-tier structure: Revenue Secretary Office, GST Implementation Committee, Standing Committees

Sectoral Groups representing various economy sectors

Challenges and Impact:

States’ financial autonomy affected

Some states faced revenue shortfalls during transition

Compensation mechanism developed but created state dependency on Centre

GST compensation cess issues during COVID-19 period

Uncertainty in revenue sharing arrangements

Changed state revenue generation capabilities

3. Changes in Union Territory Administration

Jammu & Kashmir and Ladakh (2019):

Converted from state to two UTs

J&K UT has legislature; Ladakh UT without legislature

Both administered by Lt. Governors representing President under Article 239

Dadra and Nagar Haveli and Daman and Diu:

Merged into single UT (effective January 26, 2020)

B. Institutional Reforms

1. Inter-State Council

Constitutional Basis: Article 263 (non-permanent, constituted by President)

Establishment: First set up in 1990 through Presidential Order based on Sarkaria Commission recommendations

Current Status (as of 2025):

11th meeting held in 2016 after decade-long gap

Only 11 meetings in 26 years (highly infrequent)

Last major meeting in 2016; renewed focus needed

Composition:

Chairperson: Prime Minister of India

Members: Chief Ministers of all states, CMs of UTs with legislatures, Administrators of UTs without legislatures, Six Union Cabinet Ministers nominated by PM

Permanent Invitees: Five Ministers of Cabinet rank/Ministers of State (independent charge)

Secretariat: Led by Secretary from Government of India; also serves as Zonal Councils secretariat

Functions:

Investigate and discuss subjects of common interest to Centre-states or inter-states

Make recommendations for better policy and action coordination

Deliberate on matters referred by Chairman

Inquire into and advise on inter-state disputes

Vision & Mission (Current):

Develop ISC Secretariat as vibrant organization

Create strong institutional framework for cooperative federalism

Activate ISC and Zonal Councils through regular meetings

Monitor implementation of recommendations

Challenges:

Irregular meetings undermine its effectiveness

Need for stronger enforcement mechanisms

Limited follow-through on recommendations

2. NITI Aayog (National Institution for Transforming India)

Establishment: January 1, 2015 (replaced Planning Commission)

Key Features:

Platform for cooperative federalism bringing Centre-states as equal partners

“Team India” spirit embodied in structure and functioning

Role in Centre-State Relations:

Enhanced Cooperative Federalism: Acts as bridge between central and state governments, aligning regional priorities with national goals

Competitive Federalism: Promotes state competition through measurable performance indicators

Policy Coordination: Rather than micro-managing sectoral plans, focuses on coordination

Governing Council Meetings:

PM chairs meetings

Attended by Chief Ministers, Lt. Governors, Union Ministers

10th Meeting (July 2025): PM emphasized cooperative federalism as foundation of India’s progress, need for Centre-states-UTs to work as Team India for Viksit Bharat @2047

Key Initiatives:

State Institutions of Transformation (SITs) for better governance

NITI Forum for North East

SATH-E programme

Poshan Abhiyan

State Health Index

Education reforms

Aspirational Districts Program

Fiscal Health Index (2025): Launched January 24, 2025, assessing 18 major states’ fiscal health for FY 2022-23

Various performance indices: SDG India Index 2023-24, India Innovation Index 2024

Challenges:

Only meets once a year (limited federal dialogue)

Centre using financial leverage to enforce compliance (e.g., withholding Tamil Nadu’s Samagra Shiksha funds for opposing NEP 2020)

Undermining federalism through conditional funding

Recommendations for Strengthening:

Regularize NITI Aayog and GST Council meetings

Ensure ongoing dialogue and timely dispute resolution

Long-term strategic planning aligned with Viksit Bharat @2047

Periodic reviews with measurable targets

3. Zonal Councils

Structure: Five Zonal Councils for regional cooperation

Northern Zonal Council (includes Haryana, Himachal Pradesh, Punjab, Rajasthan, Delhi, J&K, Ladakh, Chandigarh)

Central Zonal Council

Eastern Zonal Council

Western Zonal Council

Southern Zonal Council

Chairman: Union Home Minister Amit Shah

Recent Activity:

32nd Northern Zonal Council Meeting: November 17, 2025, at Faridabad, Haryana

25th Central Zonal Council Meeting: June 24, 2025, at Varanasi

24th Central Zonal Council: October 7, 2023, at Narendra Nagar

Sarkaria Commission Recommendation: Should meet at least twice yearly for better coordination

Punchhi Commission Recommendation: ISC Secretariat can function as Zonal Councils secretariat

Secretariat: Managed by Inter-State Council Secretariat, Ministry of Home Affairs

C. Financial Relations Updates

1. 15th Finance Commission (2021-26) Implemented Changes

Vertical Devolution:

41% share of central taxes to states (reduced from 42% to adjust for J&K and Ladakh UTs)

This was lower than 14th FC’s 42% recommendation

Fiscal Roadmap:

Centre: Reduce fiscal deficit from 6.8% (FY22) to 4% of GDP by 2025-26

States: Fiscal deficit limits of 4% GSDP (2021-22), 3.5% (2022-23), 3% (2023-26)

Additional borrowing: 0.5% GSDP for states implementing power sector reforms

Key Recommendations:

High-level inter-governmental group to review FRBM Act

Strengthen income and asset-based taxation

Address GST inverted duty structure

Establish independent Fiscal Council

States to harmonize fiscal responsibility laws with Centre

Off-budget financing should not be used

Performance-based transfers

Grants Allocation:

₹4.36 lakh crore to local bodies

₹45,000 crore performance-based incentive for agricultural reforms

₹4,800 crore (2022-26) for enhancing educational outcomes

New Recommendations:

Establishment of All India Medical and Health Service

Non-lapsable fund for defence and internal security modernization

Minimum funding threshold for Centrally Sponsored Schemes

2. 16th Finance Commission (2026-31) Process

Constitution: December 31, 2023

Chairman: Dr. Arvind Panagariya (economist)

Members:

Ajay Narayan Jha

Annie George Mathew

Manoj Panda

Soumya Kanti Ghosh (part-time)

Secretary: Ritvik Ranjan Pandey

Tenure: Initially until October 31, 2025; extended to November 30, 2025

Report Submission: Submitted to President Droupadi Murmu on November 16, 2025

Coverage Period: Five years from April 1, 2026 to March 31, 2031

Next Steps:

Finance Ministry examining recommendations

Will be tabled in Parliament by Union Finance Minister under Article 281

Report to be available in public domain after Parliamentary tabling

Key Focus Areas:

Equitable resource distribution

Grants-in-aid principles

Strengthening local governance

Disaster management financing

Urbanization challenges

3. Centrally Sponsored Schemes (CSS) Changes

Background:

Following 14th FC and abolition of Plan-Non Plan distinction (2017), CSS and Central Sector schemes became primary mode of specific purpose transfers

Current Status (2024-25):

75 CSSs in 3 categories

Constitute around 10.4% of Centre’s budget expenditure

28 CSS in operation covering rural development, education, health, skill development

All transfers to states routed through Consolidated Fund of State

Restructuring (2016-17 onwards):

Number reduced from 147 to 66 schemes

Classified as: Core of Core schemes, Core schemes, Optional schemes

Core schemes: 60:40 Centre-State funding pattern (general states)

Special Category States: 90:10 (8 NE states + 3 Himalayan states – Uttarakhand, Himachal Pradesh, J&K)

UTs without Legislature: 100% Centre funding

Impact of Changes:

State share increased from average 7-25% (2012-15) to 36-40% (2016 onwards)

Centre’s share for CSS reduced from 93% (2012-13) to 64% (2019-20)

Additional financial burden on states

Example: In 2023-24 budget, Rs. 1,339.76 crore state share for 10 selected schemes

Central Sector Schemes Growth:

Fully funded by Central Government

Share increased at expense of CSS (more centralization)

States have no say in Central Sector Schemes

Budget allocation: ₹6.67 lakh crore

15th FC Recommendations on CSS:

Funding pattern should be fixed upfront transparently and kept stable

Threshold amount below which CSS funding may be stopped

Third-party evaluation of all CSS within stipulated timeframe

Financing based on bilaterally agreed ‘compacts’ related to specific objectives

Challenges:

Increasing state financial burden

Growing centralization of social sector policies

States’ reduced flexibility in utilizing funds

Need for restoration of flexi fund (25% of CSS could be spent per state priorities in 12th Plan)

4. GST Compensation Mechanism

Background: States guaranteed compensation for revenue loss for five years (2017-22)

Challenges:

COVID-19 pandemic severely impacted GST collections

Compensation cess shortfall created Centre-state tensions

Revenue uncertainty for states

Current Issues:

GST compensation mechanism ended in June 2022

States continue to demand fair revenue sharing

Need for regular GST Council meetings to address issues

D. Judicial Pronouncements (Recent)

1. Supreme Court Verdict on Governor’s Powers (Tamil Nadu Case, 2025)

Issue: Tamil Nadu Governor withheld assent to state bills and referred re-enacted bills to President

SC Ruling (April 2025):

Governors must act on state bills in time-bound manner

Must follow aid and advice of Council of Ministers per Article 200

No “absolute veto” or “pocket veto” under Article 200

Governors cannot indefinitely delay action on bills

Governors bound to follow Council of Ministers’ advice

Clear Timelines Prescribed:

Governor must decide within specific timeframe whether to grant assent or reserve for President

When bill presented after re-enactment, Governor must give assent

Implications:

Curbs misuse of gubernatorial discretion to stall state legislatures

Reaffirms Governors are constitutional heads, not political actors

Emphasizes primacy of legislative process, limits executive overreach

Sets precedent for similar cases in Kerala, West Bengal, Telangana, Punjab

2. S.R. Bommai vs Union of India (1994) – Continued Relevance

Historical Landmark: Supreme Court restricted arbitrary impositions of President’s Rule

Key Propositions:

President’s satisfaction for Article 356 proclamation subject to judicial review

Article 356 to be used as measure of last resort when all alternatives fail

Invoked only for political crisis, internal subversion, physical breakdown, non-compliance with Central directives

Warning should be issued to state in specific terms before invoking

Material facts and grounds should be integral part of proclamation for effective Parliamentary control

Governor’s report must be ‘speaking document’ with wide publicity

Explanation from state before taking action under Article 356

Legislative Assembly should not be dissolved initially

Recent Application:

President’s Rule in Manipur imposed February 2025, extended August 2025 for six months

Manipur has had President’s Rule 11 times (most frequent)

Only Chhattisgarh and Telangana never had President’s Rule

Punchhi Commission Recommendation: Amend Constitution to incorporate S.R. Bommai guidelines to strengthen Centre-state relations

3. Supreme Court Judgments on Federalism (2024)

Mineral Royalty Case (2024):

8:1 majority held Parliament’s power on mines and minerals cannot usurp states’ legislative powers

States have power to tax mines and minerals

Clear division of legislative powers critical for federal structure

Industrial Alcohol Case (Lalta Prasad Vaish, 2024):

Similar 8:1 majority

Union’s List I powers cannot take away states’ List II powers

State governments have power to regulate industrial alcohol

Sub-classification within SC/ST (November 5, 2024):

Nine-judge bench unanimously held Article 31C continues to exist

States have power to create sub-classifications within SC/ST categories

West Bengal vs CBI (July 10, 2024):

Division Bench upheld maintainability of West Bengal’s Original Suit against Union

Reinforced state autonomy in law enforcement under Article 131

Bilkis Bano Case (January 2024):

Supreme Court quashed Gujarat government’s remission order for 11 convicts

Criticized Gujarat government’s complicity, acting “in tandem” with convicts

Held remission violated rule of law

Courts have authority to quash remission orders though decision rests in administrative domain

Delhi Government vs Lieutenant Governor:

Supreme Court 2023 judgment clarified Delhi government’s control over civil servants

Significant for UT governance and Centre-UT relations

4. Article 370 Abrogation Case (2023)

Supreme Court Verdict:

Upheld C.O. 272 (applying all Constitution provisions to J&K)

Upheld Presidential power to abrogate Article 370 without Constituent Assembly recommendation

Held J&K had no internal sovereignty but was feature of asymmetric federalism

Small win for petitioners: Para 2 of C.O. 272 unconstitutional (using Article 367 interpretation clause to amend Article 370)

Left J&K reorganization constitutionality unanswered citing Centre’s statehood restoration assurance

E. Challenges to Cooperative Federalism

1. Political Polarization

Key Issues:

Deep divisions between political parties hinder Centre-state cooperation

Different parties governing Centre and states lead to policy paralysis

Breakdown in communication affects governance and collaboration

Disagreements stall joint decision-making, weaken trust

Examples:

Non-Congress governments since 1967 opposing centralization

Recent tensions over farm laws, GST compensation

States’ opposition to certain Central policies (e.g., NEP 2020)

2. Fiscal Centralization

Main Concerns:

States’ heavy reliance on Central funds limits autonomy

Reduced flexibility in planning and executing own projects

Conditional transfers undermine state priorities

Increasing CSS cost-sharing burden on states

Declining state shares in grants alongside higher devolution

Recent Issues:

Tamil Nadu: Demanded 50% share in central taxes (vs current 33%)

Punjab: Demanded fair Yamuna water rights and financial aid for border security

Financial leverage used to enforce compliance (Samagra Shiksha funds withheld from Tamil Nadu)

3. Administrative Bottlenecks

Challenges:

Inadequate staffing and training

Poor communication and coordination

Bureaucratic red tape slows policy implementation

All-India Services management tensions

4. Over-Centralization

Manifestations:

Centre enjoys more power; most important subjects in Union List

Frequent conflicts as Centre imposes rules states find discriminatory

Article 356 (President’s Rule) misuse

Centre’s encroachment on State List subjects

Examples:

President’s Rule imposed 125+ times since 1950 (often arbitrarily)

Indira Gandhi government imposed President’s Rule 27 times citing political instability

Deployment of Central forces without state consent

5. Lack of Federal Dialogue

Key Problems:

Limited NITI Aayog meetings (once a year)

Delayed GST Council sessions

Irregular Inter-State Council meetings (11 times in 26 years)

Shift from collective solutions to individual grievances

Policy paralysis in GST reforms and compensation disputes

6. Uniform Approach Ignoring Diversity

Challenge: Centre’s one-size-fits-all approach doesn’t work in diverse India

Examples:

NEP 2020 implementation without adequate state flexibility

Centrally Sponsored Schemes without considering state heterogeneity

7. Governor’s Partisan Role

Ongoing Issues:

Discriminatory and partisan role of Governors

Politically motivated appointments and dismissals

Delay in giving assent to state bills (Tamil Nadu, Kerala, West Bengal, Telangana, Punjab)

Functioning as Centre’s agents rather than constitutional heads

8. Treaty-Making Power

Issue: Centre’s power to make international treaties without state consultation

Impact: Financial obligations on states from treaties without their input

Punchhi Commission Recommendation: Financial obligations from treaties should be permanent Finance Commission reference

F. Measures to Strengthen Centre-State Relations

1. Institutional Mechanisms

Recommendations:

Revitalize Inter-State Council: Regular meetings, follow-up mechanisms, stronger enforcement

Strengthen NITI Aayog: Regularize meetings, ensure meaningful dialogue

Activate Zonal Councils: Meet twice yearly per Sarkaria Commission recommendation

GST Council: Regular meetings to address compensation and reform issues

Establish Inter-State Trade and Commerce Commission under Article 307

2. Financial Empowerment

Key Measures:

Timely release of states’ share in central taxes

Expand states’ borrowing capacity with reasonable conditions

Ensure adequate financial resources for essential services delivery

Review and reduce cesses and surcharges

Fair GST revenue sharing with regular review

Remove profession tax ceiling

3. Gubernatorial Reforms

Sarkaria and Punchhi Commission Recommendations:

Fixed five-year tenure for Governors

Appoint eminent, non-partisan persons from outside state

Prescribe Chief Minister consultation in appointment

Removal not at Centre’s sweet will

Apply impeachment procedure similar to President

Timely action on state bills (six months maximum)

End role as University Chancellors

4. Article 356 Reforms

Recommendations:

Use only as last resort after exhausting alternatives

Incorporate S.R. Bommai guidelines in Constitution

Provide framework for “localized emergency” under Article 355

Warning to state before imposition

Governor’s report must be speaking document

Don’t dissolve Assembly initially

5. Legislative Coordination

Measures:

Consult states before Concurrent List legislation

Centre’s restraint in asserting supremacy on State List matters

Involve states in treaty-making affecting their finances

Six-month timeline for Presidential action on state bills

6. All-India Services Enhancement

Recommendations:

Create new All-India Services (health, education, engineering, judiciary)

Reforms with state consultation

Better management and deputation policies

7. Rajya Sabha Reforms

Punchhi Commission Recommendations:

Equality of representation for all states irrespective of population

Remove factors inhibiting role as representative forum of states

8. Planning and CSS Reforms

Measures:

NITI Aayog focus on coordination, not micro-managing

Allow states flexibility within national frameworks

Avoid financial conditionalities undermining autonomy

Cost-sharing provisions in Central legislations involving states

Restore flexi fund for CSS (25% state discretion)

9. Cooperative and Competitive Federalism Balance

Approaches:

Promote cooperative federalism through dialogue platforms

Encourage competitive federalism through performance-based incentives

Team India approach for Viksit Bharat @2047

Long-term strategic planning with measurable targets

10. Transparency and Accountability

Measures:

Annual assessment of fiscal legislation by independent body

No off-budget financing

Standardized framework for contingent liabilities reporting

Improve accuracy of macroeconomic and fiscal forecasting

Summary Tables

Table 1: Articles Related to Centre-State Legislative Relations

| Article | Subject-Matter |

|---|---|

| 245 | Extent of laws made by Parliament and state legislatures |

| 246 | Subject-matter of laws made by Parliament and state legislatures |

| 247 | Power of Parliament to provide for establishment of certain additional courts |

| 248 | Residuary powers of legislation |

| 249 | Power of Parliament to legislate on State List in national interest |

| 250 | Power of Parliament to legislate on State List during Emergency |

| 251 | Inconsistency between laws under Articles 249-250 and state laws |

| 252 | Power of Parliament to legislate for states by consent |

| 253 | Legislation for implementing international agreements |

| 254 | Inconsistency between Parliamentary laws and state laws |

| 255 | Requirements of recommendations and sanctions as procedural matters |

Table 2: Articles Related to Centre-State Administrative Relations

| Article | Subject-Matter |

|---|---|

| 256 | Obligation of states and the Union |

| 257 | Control of Union over states in certain cases |

| 257A | Assistance to states by Union armed forces (Repealed) |

| 258 | Union’s power to confer powers on states |

| 258A | States’ power to entrust functions to Union |

| 259 | Armed Forces in Part B states (Repealed) |

| 260 | Jurisdiction of Union outside India |

| 261 | Public acts, records and judicial proceedings |

| 262 | Adjudication of inter-state river water disputes |

| 263 | Provisions for Inter-State Council |

Table 3: Articles Related to Centre-State Financial Relations

| Article | Subject-Matter |

|---|---|

| Distribution of Revenues | |

| 268 | Duties levied by Union but collected and appropriated by states |

| 268A | Service tax levied by Union and collected/appropriated by Union and states |

| 269 | Taxes levied and collected by Union but assigned to states |

| 270 | Taxes levied and distributed between Union and states |

| 271 | Surcharge on certain duties and taxes for Union |

| 272 | Taxes levied and collected by Union, distributed to states (Repealed) |

| 273 | Grants in lieu of export duty on jute |

| 274 | Presidential recommendation for bills affecting taxation |

| 275 | Grants from Union to certain states |

| 276 | Taxes on professions, trades, callings, employments |

| 277 | Savings |

| 278 | Agreement with Part B states on financial matters (Repealed) |

| 279 | Calculation of “net proceeds” |

| 280 | Finance Commission |

| 281 | Recommendations of Finance Commission |

| Miscellaneous Financial Provisions | |

| 282 | Expenditure defrayable by Union or state |

| 283 | Custody of Consolidated Funds, Contingency Funds, public accounts |

| 284 | Custody of suitors’ deposits and court money |

| 285 | Exemption of Union property from state taxation |

| 286 | Restrictions on tax on sale or purchase of goods |

| 287 | Exemption from taxes on electricity |

| 288 | Exemption from taxation on water or electricity in certain cases |

| 289 | Exemption of state property and income from Union taxation |

| 290 | Adjustment for certain expenses and pensions |

| 290A | Annual payment to certain Devaswom Funds |

| 291 | Privy purse sums of Rulers (Repealed) |

| Borrowing | |

| 292 | Borrowing by Government of India |

| 293 | Borrowing by states |

Table 4: Distribution of Legislative Subjects – Current Numbers

| List | Number of Subjects | Key Examples |

|---|---|---|

| Union List (List-I) | 100 (originally 97) | Defence, banking, foreign affairs, currency, atomic energy, insurance, communication, inter-state trade, census, audit |

| State List (List-II) | 61 (originally 66) | Public order, police, public health, agriculture, prisons, local government, fisheries, markets |

| Concurrent List (List-III) | 52 (originally 47) | Criminal law, civil procedure, marriage and divorce, population control, electricity, labour welfare, economic planning, drugs, newspapers |

Table 5: Finance Commission Comparison

| Feature | 15th Finance Commission (2021-26) | 16th Finance Commission (2026-31) |

|---|---|---|

| Chairman | N. K. Singh | Dr. Arvind Panagariya |

| Period | 2021-26 (6 years) | 2026-31 (5 years) |

| Vertical Devolution | 41% | To be announced |

| Report Submitted | February 1, 2021 | November 16, 2025 |

| Key Focus | Fiscal consolidation, COVID recovery, performance-based transfers | Equitable distribution, local governance, disaster management |

| Fiscal Deficit Target (Centre) | 4% of GDP by 2025-26 | To be recommended |

| Fiscal Deficit Target (States) | 4% (2021-22), 3.5% (2022-23), 3% (2023-26) | To be recommended |

Table 6: GST Structure

| Type | Levied By | Applied To | Purpose |

|---|---|---|---|

| CGST | Central Government | Intra-state transactions | Centre’s share of tax |

| SGST | State Government | Intra-state transactions | State’s share of tax |

| IGST | Central Government | Inter-state transactions | Distributed between origin and destination states |

Table 7: Centrally Sponsored Schemes Funding Pattern

| Category | Centre Share | State Share |

|---|---|---|

| General States | 60% | 40% |

| 8 NE States + 3 Himalayan States (Uttarakhand, Himachal Pradesh, J&K) | 90% | 10% |

| UTs without Legislature | 100% | 0% |

| Select Schemes | 80% | 20% |

Table 8: Major Commissions on Centre-State Relations – Summary

| Commission/Committee | Year | Chairman | Key Focus | Implementation Status |

|---|---|---|---|---|

| Administrative Reforms Commission | 1966-69 | Morarji Desai, K Hanumanthayya | Inter-State Council, Governor reforms, financial resources | Not implemented |

| Rajamannar Committee | 1969-71 | Dr. P V Rajamannar | State autonomy, abolish President’s Rule, disband Planning Commission | Ignored by Centre |

| Anandpur Sahib Resolution | 1973 | Akali Dal | Restrict Centre to defence, foreign affairs, communications, currency | Not accepted |

| West Bengal Memorandum | 1977 | Communist Government | Federal structure, 75% revenue to states, abolish All-India Services | Not accepted |

| Sarkaria Commission | 1983-87 | R S Sarkaria | 247 recommendations on all aspects | 180/247 implemented by 2011 |

| Punchhi Commission | 2007-10 | Madan Mohan Punchhi | 310+ recommendations, updated for 21st century | Under consideration |

Table 9: Recent Supreme Court Judgments Impacting Centre-State Relations

| Case | Year | Key Ruling | Impact |

|---|---|---|---|

| S.R. Bommai vs Union of India | 1994 | Article 356 subject to judicial review, use as last resort | Restricted arbitrary President’s Rule |

| Article 370 Abrogation Case | 2023 | Upheld abrogation, J&K reorganization | Changed federal asymmetry |

| Delhi Government vs LG | 2023 | Clarified Delhi govt’s control over civil servants | UT governance autonomy |

| West Bengal vs CBI | July 2024 | Upheld maintainability of state’s suit against Union | State autonomy in law enforcement |

| Mineral Royalty Case | 2024 | States can tax mines and minerals | Enhanced state fiscal powers |

| Industrial Alcohol Case | 2024 | States can regulate industrial alcohol | Strengthened state legislative powers |

| Tamil Nadu Governor Case | April 2025 | Governors must act timebound, no pocket veto | Limited gubernatorial discretion |

| Bilkis Bano Case | January 2024 | Quashed Gujarat remission order | Limits executive arbitrariness |

Discover more from Simplified UPSC

Subscribe to get the latest posts sent to your email.