Beed model crop insurance scheme

Context:

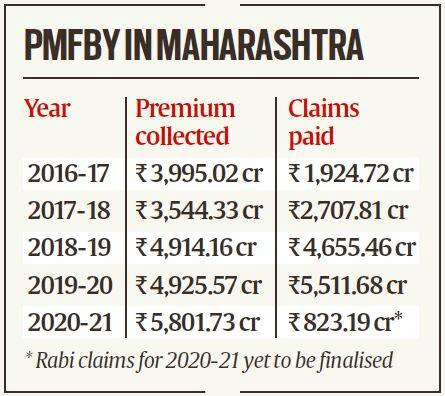

Recently, the Maharashtra Government asked the Prime Minister for state-wide implementation of the ‘Beed model’ of the crop insurance scheme Pradhan Mantri Fasal Bima Yojna (PMFBY).

What is Beed model

- Located in the drought-prone Marathwada region, the district of Beed presents a challenge for any insurance company.

- During the 2020 kharif season, tenders for implementation did not attract any bids. So, the state Agriculture Department decided to tweak the guidelines for the district.

- The state-run Indian Agricultural Insurance Company implemented the scheme.

- Under the new guidelines, the insurance company provided a cover of 110% of the premium collected, with caveats.

- If the compensation exceeded the cover provided, the state government would pay the bridge amount.

- If the compensation was less than the premium collected, the insurance company would keep 20% of the amount as handling charges and reimburse the rest to the state government.

Reason for Implementing this Model:

- Another Source of Fund: In most years, the claims-to-premium ratio is low. In the Beed model, the profit of the insurance company is expected to reduce and the state government would access another source of funds.

- Reduce the Burden of Financing PMFBY: The reimbursed amount can lead to lower budgetary provision for PMFBY by the state for the following year, or help in financing the paying the bridge amount in case of a year of crop loss.

Challenges:

- Questions remain on how the state government is going to raise the excess amount, and how the reimbursed amount would be administered.

- For farmers, this model does not seem to have any direct benefit.

- The chances of the model being implemented for the present Kharif season appear slim.

Pradhan Mantri Fasal Bima Yojana

About: PMFBY was launched in 2016.

- It provides a comprehensive insurance cover against failure of the crop thus helping in stabilising the income of the farmers.

Scope: All food & oilseed crops and annual commercial/horticultural crops for which past yield data is available.

Premium: The prescribed premium is 2% to be paid by farmers for all Kharif crops and 1.5% for all rabi crops. In the case of annual commercial and horticultural crops, the premium is 5%.

- Premium cost over and above the farmer share is equally subsidized by States and GoI.

- However, GoI shared 90% of the premium subsidy for North Eastern States to promote the uptake in the region.

Source: Indian Express

Error: View f5ba0dda2n may not exist

Discover more from Simplified UPSC

Subscribe to get the latest posts sent to your email.