International Monetary Fund (IMF)

About:

- The International Monetary Fund (IMF) is an international financial institution,

- Headquartered in Washington, D.C.

- Formed in July 1944,at the Bretton Woods Conference primarily

- Formed by the ideas of Harry Dexter White and John Maynard Keynes,

- Consisting of 190 countries

- Countries working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world while periodically depending on the World Bank for its resources.

- It came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system.

- It now plays a central role in the management of balance of payments difficulties and international financial crises.

- Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money.

- The IMF works to improve the economies of its member countries.

- The organization’s objectives stated in the Articles of Agreement are:

- to promote international monetary co-operation,

- international trade,

- high employment,

- exchange-rate stability,

- sustainable economic growth,

- IMF funds come from two major sources: quotas and loans. Quotas, which are pooled funds of member nations, generate most IMF funds.

- The size of a member’s quota depends on its economic and financial importance in the world.

- Nations with greater economic significance have larger quotas.

- The quotas are increased periodically as a means of boosting the IMF’s resources in the form of special drawing rights.

IMF MEMBERS AND (QUOTA)

- IMF Members: Any other state, whether or not a member of the UN, may become a member of the IMF in accordance with IMF Articles of Agreement and terms prescribed by the Board of Governors.

- Membership in the IMF is a prerequisite to membership in the IBRD.

- Pay a quota subscription: On joining the IMF, each member country contributes a certain sum of money, called a quota subscription, which is based on the country’s wealth and economic performance (Quota Formula).

- It is a weighted average of GDP (weight of 50 percent)

- Openness (30 percent),

- Economic variability (15 percent),

- International reserves (5 percent).

- GDP of member country is measured through a blend of GDP—based on market exchange rates (weight of 60 percent) and on PPP exchange rates (40 percent).

- Special Drawing Rights (SDRs) is the IMF’s unit of account and not a currency.

- The currency value of the SDR is determined by summing the values in U.S. dollars, based on market exchange rates, of a SDR basket of currencies

- SDR basket of currencies includes the U.S. dollar, Euro, Japanese yen, pound sterling and the Chinese renminbi (included in 2016).

- The SDR currency value is calculated daily (except on IMF holidays or whenever the IMF is closed for business) and the valuation basket is reviewed and adjusted every five years.

- Quotas are denominated (expressed) in SDRs.

- SDRs represent a claim to currency held by IMF member countries for which they may be exchanged.

- Members’ voting power is related directly to their quotas (the amount of money they contribute to the institution).

- IMF allows each member country to choose its own method of determining the exchange value of its money. The only requirements are that the member no longer base the value of its currency on gold (which has proved to be too inflexible) and inform other members about precisely how it is determining the currency’s value.

Objectives of the IMF

IMF was developed as an initiative to promote international monetary cooperation, enable international trade, achieve financial stability, stimulate high employment, diminish poverty in the world, and sustain economic growth. Initially, there were 29 countries with a goal of redoing the global payment system. Today, the organization has 189 members. The main objectives of the International Monetary Fund (IMF) are mentioned below:

- To improve and promote global monetary cooperation of the world.

- To secure financial stability by eliminating or minimizing the exchange rate stability.

- To facilitate a balanced international trade.

- To promote high employment through economic assistance and sustainable economic growth.

- To reduce poverty around the world.

What are the functions of the IMF?

IMF mainly focuses on supervising the international monetary system along with providing credits to the member countries. The functions of the International Monetary Fund can be categorized into three types:

- Regulatory functions: IMF functions as a regulatory body and as per the rules of the Articles of Agreement, it also focuses on administering a code of conduct for exchange rate policies and restrictions on payments for current account transactions.

- Financial functions: IMF provides financial support and resources to the member countries to meet short term and medium term Balance of Payments (BOP) disequilibrium.

- Consultative functions: IMF is a centre for international cooperation for the member countries. It also acts as a source of counsel and technical assistance.

Organizational Structure of International Monetary Fund (IMF)

The United Nations is the parent organization that handles the proper functioning and administration of the IMF. The IMF is headed by a Managing Director who is elected by the Executive Board for a 5-year term of office. The International Monetary Fund (IMF) consists of the Board of Governors, Ministerial Committees, and the Executive Board.

To know more about the organizational structure of IMF, refer to the table below:

Structure of the International Monetary Fund (IMF)

| Governing Bodies of IMF | Roles and Responsibilities |

| Board of Governors | Each governor of the Board of Governors is appointed by his/her respective member country. Elects or appoints executive directors to the Executive Board. Board of Governors is advised by the International Monetary and Financial Committee (IMFC) and the Development Committee. An annual meet up between the Board of Governors and the World Bank Group is conducted during the IMF–World Bank Annual Meetings to discuss the work of their respective institutions. |

| Ministerial Committees International Monetary and Financial Committee (IMFC) Development Committee | It manages the international monetary and financial system. Amendment of the Articles of Agreement. To solve the issues in the developing countries that are related to economic development. |

| Executive Board | It is a 24-member board that discusses all the aspects of the Funds. The Board normally makes decisions based on consensus, but sometimes formal votes are taken. |

IMF and India

- International regulation by IMF in the field of money has certainly contributed towards expansion of international trade. India has, to that extent, benefitted from these fruitful results.

- Post-partition period, India had serious balance of payments deficits, particularly with the dollar and other hard currency countries. It was the IMF that came to her rescue.

- The Fund granted India loans to meet the financial difficulties arising out of the Indo–Pak conflict of 1965 and 1971.

- From the inception of IMF up to March 31, 1971, India purchased foreign currencies of the value of Rs. 817.5 crores from the IMF, and the same have been fully repaid.

- Since 1970, the assistance that India, as other member countries of the IMF, can obtain from it has been increased through the setting up of the Special Drawing Rights (SDRs created in 1969).

- India had to borrow from the Fund in the wake of the steep rise in the prices of its imports, food, fuel and fertilizers.

- In 1981, India was given a massive loan of about Rs. 5,000 crores to overcome foreign exchange crisis resulting from persistent deficit in balance of payments on current account.

- India wanted large foreign capital for her various river projects, land reclamation schemes and for the development of communications. Since private foreign capital was not forthcoming, the only practicable method of obtaining the necessary capital was to borrow from the International Bank for Reconstruction and Development (i.e. World Bank).

- India has availed of the services of specialists of the IMF for the purpose of assessing the state of the Indian economy. In this way India has had the benefit of independent scrutiny and advice.

- The balance of payments position of India having gone utterly out of gear on account of the oil price escalation since October 1973, the IMF has started making available oil facility by setting up a special fund for the purpose.

- Early 1990s when foreign exchange reserves – for two weeks’ imports as against the generally accepted ‘safe minimum reserves’ of three month equivalent — position were terribly unsatisfactory. Government of India’s immediate response was to secure an emergency loan of $2.2 billion from the International Monetary Fund by pledging 67 tons of India’s gold reserves as collateral security. India promised IMF to launch several structural reforms (like devaluation of Indian currency, reduction in budgetary and fiscal deficit, cut in government expenditure and subsidy, import liberalisation, industrial policy reforms, trade policy reforms, banking reforms, financial sector reforms, privatization of public sector enterprises, etc.) in the coming years.

- The foreign reserves started picking up with the onset of the liberalisation policies.

- India has occupied a special place in the Board of Directors of the Fund. Thus, India had played a creditable role in determining the policies of the Fund. This has increased the India’s prestige in the international circles.

IMF‘s Criticism

- IMF’s governance is an area of contention. For decades, Europe and the United States have guaranteed the helm of the IMF to a European and that of the World Bank to an American. The situation leaves little hope for ascendant emerging economies that, despite modest changes in 2015, do not have as large an IMF voting share as the United States and Europe.

- Conditions placed on loans are too intrusive and compromise the economic and political sovereignty of the receiving countries. ‘Conditionality’ refers to more forceful conditions, ones that often turn the loan into a policy tool. These include fiscal and monetary policies, including such issues as banking regulations, government deficits, and pension policy. Many of these changes are simply politically impossible to achieve because they would cause too much domestic opposition.

- IMF imposed the policies on countries without understanding the distinct characteristics of the countries that made those policies difficult to carry out, unnecessary, or even counter-productive.

- Policies were imposed all at once, rather than in an appropriate sequence. IMF demands that countries it lends to privatize government services rapidly. It results in a blind faith in the free market that ignores the fact that the ground must be prepared for privatization.

IMF Reforms

- IMF Quota: a member can borrow up to 200 percent of its quota annually and 600 percent cumulatively. However, access may be higher in exceptional circumstances.

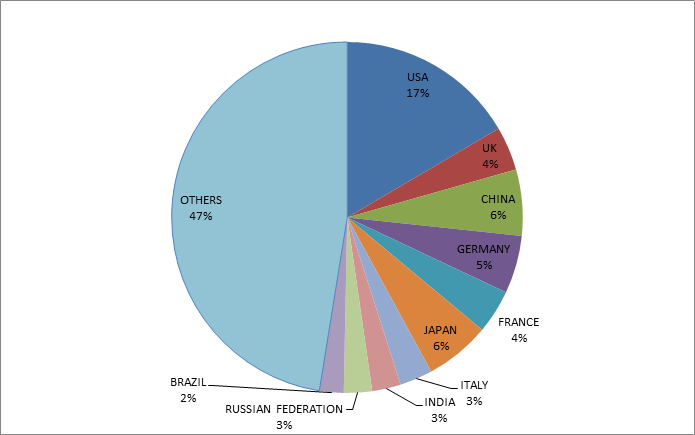

- IMF quota simply means more voting rights and borrowing permissions under IMF. But it is unfortunate that IMF Quota’s formula is designed in such a way that USA itself has 17.7% quota which is higher than cumulative of several countries. The G7 group contains more than 40% quota where as countries like India & Russia have only 2.5% quota in IMF.

- Due to discontent with IMF, BRICS countries established a new organization called BRICS bank to reduce the dominance of IMF or World Bank and to consolidate their position in the world as BRICS countries accounts for 1/5th of WORLD GDP and 2/5th of world population.

- It is almost impossible to make any reform in the current quota system as more than 85% of total votes are required to make it happen. The 85% votes does not cover 85% countries but countries which have 85% of voting power and only USA has voting share of around 17% which makes it impossible to reform quota without consent of developed countries.

- 2010 Quota Reforms approved by Board of Governors were implemented in 2016 with delay because of reluctance from US Congress as it was affecting its share.

- Combined quotas (or the capital that the countries contribute) of the IMF increased to a combined SDR 477 billion (about $659 billion) from about SDR 238.5 billion (about $329 billion). It increased 6% quota share for developing countries and reduced same share of developed or over represented countries.

- More representative Executive Board: 2010 reforms also included an amendment to the Articles of Agreement established an all-elected Executive Board, which facilitates a move to a more representative Executive Board.

- The 15th General Quota Review (in process) provides an opportunity to assess the appropriate size and composition of the Fund’s resources and to continue the process of governance reforms.

Source: IMF