Mines and Minerals Development and Regulation Act

Context:

Successful Auction of Kuraloi (A) North Coal Odisha Mine in Second Attempt of 1st Tranche of Auction under Mines and Minerals (Development and Regulation)Act, 1957

About:

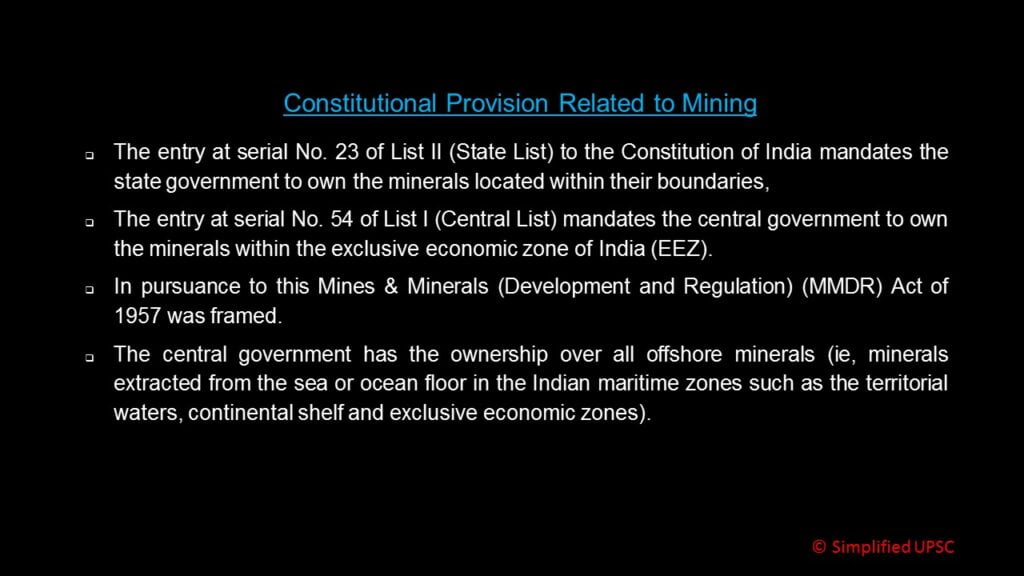

- The Mines and Minerals (Regulation and Development) Act (1957) is an Act of the Parliament of India enacted to regulate the mining sector in India.

- It was amended in 2015 and 2016. This act forms the basic framework of mining regulation in India.

- This act is applicable to all mineral except minor minerals and atomic minerals.

- It details the process and conditions for acquiring a mining or prospecting licence in India.

- Mining minor minerals comes under the purview of state governments. River sand is considered a minor mineral.

- For mining and prospecting in forest land, prior permission is needed from the Ministry of Environment and Forests.

Amendments

2015: The act was amended by The Mines and Minerals (Development and Regulation) Amendment Act, 2015 replacing the ordinance promulgated on 12 January 2015. The amendment was proposed to bring transparency to the allocation of mining licence process by auctions. It was passed in the Lok Sabha on 3 March 2015 and in the Rajya Sabha on 20 March 2015. The bill sought to bring transparency to the allocation of mining licence process by auctions.

2016: The Union Cabinet of India approved amendments in March 2016. The amendment will allow transfer of captive mining leases not granted through auction. Transfer of captive mining leases, granted otherwise than through auction, would allow mergers and acquisitions of companies and facilitate ease of doing business for companies to improve profitability and decrease costs of the companies’ dependent on supply of mineral ore from captive leases. The transfer provisions will also facilitate banks and financial institutions to liquidate stressed assets where a company or its captive mining lease is mortgaged.

The Mines and Minerals (Development and Regulation) Amendment Bill, 2021

The Mines and Minerals (Development and Regulation) Amendment Bill, 2021 was introduced in Lok Sabha on March 15, 2021. The Bill amends the Mines and Minerals (Development and Regulation) Act, 1957. The Act regulates the mining sector in India.

- Removal of restriction on end-use of minerals: The Act empowers the central government to reserve any mine (other than coal, lignite, and atomic minerals) to be leased through an auction for a particular end-use (such as iron ore mine for a steel plant). Such mines are known as captive mines. The Bill provides that no mine will be reserved for particular end-use.

- Sale of minerals by captive mines: The Bill provides that captive mines (other than atomic minerals) may sell up to 50% of their annual mineral production in the open market after meeting their own needs. The central government may increase this threshold through a notification. The lessee will have to pay additional charges for mineral sold in the open market.

- Auction by the central government in certain cases: Under the Act, states conduct the auction of mineral concessions (other than coal, lignite, and atomic minerals). Mineral concessions include mining lease and prospecting license-cum-mining lease. The Bill empowers the central government to specify a time period for completion of the auction process in consultation with the state government. If the state government is unable to complete the auction process within this period, the auctions may be conducted by the central government.

- Transfer of statutory clearances: Upon expiry of a mining lease (other than coal, lignite, and atomic minerals), mines are leased to new persons through auction. The statutory clearances issued to the previous lessee are transferred to the new lessee for a period of two years. The new lessee is required to obtain fresh clearances within these two years. The Bill replaces this provision and instead provides that transferred statutory clearances will be valid throughout the lease period of the new lessee.

- Allocation of mines with expired leases: The Bill adds that mines (other than coal, lignite, and atomic minerals), whose lease has expired, may be allocated to a government company in certain cases. This will be applicable if the auction process for granting a new lease has not been completed, or the new lease has been terminated within a year of the auction. The state government may grant a lease for such a mine to a government company for a period of up to 10 years or until the selection of a new lessee, whichever is earlier.

- Rights of certain existing concession holders: In 2015, the Act was amended to provide that mines will be leased through an auction process. Existing concession holders and applicants have been provided with certain rights including: (i) right to obtain prospecting licence or mining lease to a holder of reconnaissance permit or prospecting licence (issued before commencement of the 2015 Amendment Act), and (ii) right for grant of mining lease where the central government had given its approval or letter of intent was issued by the state government before the commencement of the 2015 Amendment Act. The Bill provides that the right to obtain a prospecting license or a mining lease will lapse on the date of commencement of the 2021 Amendment Act. Such persons will be reimbursed for any expenditure incurred towards reconnaissance or prospecting operations.

- Extension of leases to government companies: The Act provides that the period of mining leases granted to government companies will be prescribed by the central government. The Bill provides that the period of mining leases of government companies (other than leases granted through auction) may be extended on payment of additional amount prescribed in the Bill.

- Conditions for lapse of mining lease: The Act provides that a mining lease will lapse if the lessee: (i) is not able to start mining operations within two years of the grant of a lease, or (ii) has discontinued mining operations for a period of two years. However, the lease will not lapse at the end of this period if a concession is provided by the state government upon an application by the lessee. The Bill adds that the threshold period for lapse of the lease may be extended by the state government only once and up to one year.

- Non-exclusive reconnaissance permit: The Act provides for a non-exclusive reconnaissance permit (for minerals other than coal, lignite, and atomic minerals). Reconnaissance means preliminary prospecting of a mineral through certain surveys. The Bill removes the provision for this permit.

Source: PIB

Discover more from Simplified UPSC

Subscribe to get the latest posts sent to your email.