Comptroller and Auditor General of India

The fundamental basis of the parliamentary system of the Government is the responsibility of the executive to the legislature for all its actions. The legislature is able to enforce this responsibility only if it is competent to scrutinize the activities of the executive. However, not all activities of the executives can be scrutinized by any layman. Checking of the accounts and assessing the soundness of the financial transactions of the executive is the specialized job for which the constitution via articles 148 to 151 in Part V makes provisions for a Comptroller and Auditor General of India.

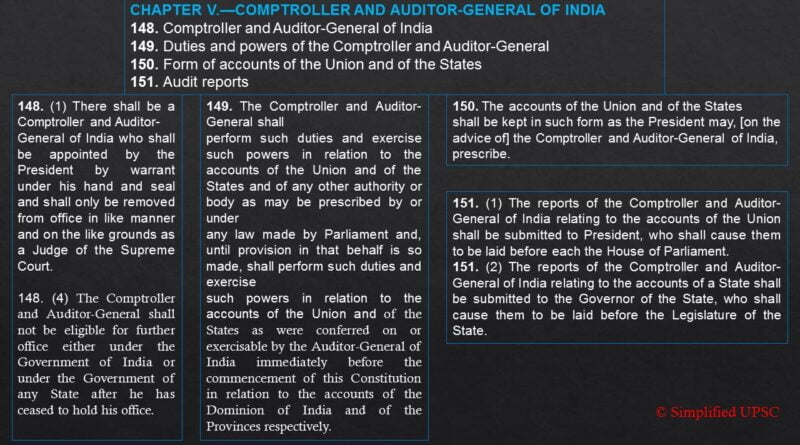

Constitutional Provisions regarding CAG

Article 148:

- There shall be a CAG of India who would be appointed by President and who can be removed from office in a manner and on grounds like Judge of a Supreme Court.

- Third schedule has the oath of affirmation for CAG

- Salary and other conditions of work to be defined by a Law enacted by the Parliament. Salary specified in second schedule

- Once left office, CAG is not eligible for a Government of India or Government of State jobs

- Conditions of service of persons serving in the Indian Audit and Accounts Department and the administrative powers of the Comptroller and Auditor-General are prescribed by President after consultation with CAG, subject to any law by parliament.

- Expenses and salary drawn upon Consolidated Fund of India

Article 149:

Duties and Powers of CAG include checking accounts of Union and States and / or other body prescribed in the Law enacted by the Parliament.

Article 150:

The accounts of Union and States will be kept in such as way that is prescribed by the President on advice of the CAG

Article 151:

- Report of CAG of Union Accounts to be submitted to President who causes them to be laid before each house of parliament

- Report of CAG of State Accounts to be submitted to Governor who causes them to be laid before state legislature.

CAG’s (DPC) Act, 1971

As per the provisions of the constitution, the CAG’s (DPC) (Duties, Powers and Conditions of Service) Act, 1971 was enacted. As per the various provisions, the duties of the CAG include the audit of:

- Receipts and expenditure from the Consolidated Fund of India and of the State and Union Territory having legislative assembly;

- Trading, manufacturing, profit and loss accounts and balance sheets, and other subsidiary accounts kept in any Government department;

- Accounts of stores and stock kept in Government offices or departments;

- Government companies as per the provisions of the Companies Act, 1956;

- Corporations established by or under laws made by Parliament in accordance with the provisions of the respective legislation;

- Authorities and bodies substantially financed from the Consolidated Funds of the Union and State Governments;

- Anybody or authority even though not substantially financed from the Consolidated Fund, the audit of which may be entrusted to the C&AG;

- Grants and loans given by Government to bodies and authorities for specific purposes; and

- Entrusted audits e.g. those of Panchayati Raj Institutions and Urban Local Bodies under Technical Guidance & Support (TGS).

Audit Reports by CAG

The C&AG presents one or more volumes of his Audit Reports to Parliament/State legislatures and Union Territories with legislative assemblies under the sectors as shown in the following graphics:

Powers of CAG in context with the companies:

The Companies Act, 1956 empowers the C&AG to:

- Appoint/ re-appoint the auditors of a Government company;

- Direct the manner in which accounts shall be audited;

- Give such instructions to the auditors in regard to any matter relating to audit;

- To conduct a supplementary or test audit of the accounts; and

- To comment upon or supplement the audit report of the statutory auditors.

An Audit Advisory Board has been set up under the Chairmanship of the C&AG, which consists of eminent persons in diverse fields. Its structure is as follows:

- Chairman is CAG

- Member Secretary is Director General (Audit) in the office of the C&AG

- Deputy Comptroller and Auditors General [ex-officio members]

- Other members eminent personalities in diverse fields. Term is 2 years for each.

Current procedure of Appointment of CAG

At present, the Comptroller and Auditor-General of India is appointed by the President of India following a recommendation by the Prime Minister. Last year, L K Advani had suggested that CAG’s appointment should be made by a bipartisan collegium consisting of the Prime Minister, the Chief Justice, the Law Minister and the Leaders of the Opposition in the Lok Sabha and the Rajya Sabha. The demand was reiterated by many people but Government did not pay attention to it. Some people have demanded for a multi-person CAG. The current salary of CAG is Rs. 90,000.

Importance of the Office of CAG

It is the importance of the CAG office, which led Dr. B.R. Ambedkar to say that the CAG was the most important officer under the Constitution of India. It is the CAG’s audit reports which helps ensure executive’s accountability to the Parliament in the sphere of financial administration. Since it conducts audit of expenditure on behalf of the Parliament, it is an agent of the Parliament and thus responsible only to it. However, in recent times questions have been raised not only with respect to the basis of the office of the CAG, but also the model of the institution of CAG and factual efficacy in the reports. The CAG’s reports on the Commonwealth Games and the auctioning of 2G Spectrum have been the immediate triggers behind these utterances.

It has been argued that the job of the CAG is merely to look at the compliance of systems, rather than questioning the policy itself. On the face of it, the argument seems valid. However, when analysed closely, in the context of changing times, it holds little water. It must be remembered that the CAG is concerned with providing a fair and transparent audit leading to credible governance. In its quest to do so, it not only needs to look at the compliance of systems, but also go deeper into issues of policy making. This is because systems and policies are not independent of each other; therefore the effect that policies have on systems need to be looked into.

Moreover, with changing times, governance has not remained confined only to the State. Not only the civil society and media but also the citizens at large have acquired a stake in ensuring that the best governance practices are followed in India.

In this context, the independence of the CAG from the executive makes it an appropriate body for oversight on the government expenditure. In the pursuance of its goals, if it needs to question the rationale behind policies and whether they confirm to the standards of ethics and fairness, it would not be improper. It must be kept in mind that the role of CAG is not that of a mere accountant to the government, rather to uphold the Constitution of India and the laws of Parliament in the field of financial administration.